February 12th, 2021 at 02:35 pm

I have a deadline set for the start of my retirement and I have a list of prerequisites to determine whether I’m in a safe-enough-for-me position to retire sooner. Each quarter I evaluate my progress against those prerequisites, and my quarterly check-in for this is aligned with my birthday instead of the standard calendar quarter. That’s because a couple of my prerequisites are based on my 60th birthday so the calculation is simpler.

Result for this check-in: Again, it's not time to retire now, but I’m continuing to make good progress.

In order to pull the plug immediately, I’d have to have these things accomplished:

Retirement account on target for 7 figures on 60th birthday

College savings on target for full funding

Mortgage paid off

Savings of basic expenses until 60th birthday set aside

No consumer debt

Currently my progress is:

100+%

54%

48%

8%

25%

Assumptions for these calculations: average annual return on investments will be 5%, no further contributions to investments, full funding = 40 semesters (8 x 5 boys), $36,000k annually for basic expenses, starting consumer debt was $10k. (At one time I had negative progress on this! For the record though, it’s at 0% interest.)

The next time I check-in on this progress will be in May at my half-birthday.

Posted in

Retirement,

Goals

|

2 Comments »

February 11th, 2021 at 08:07 pm

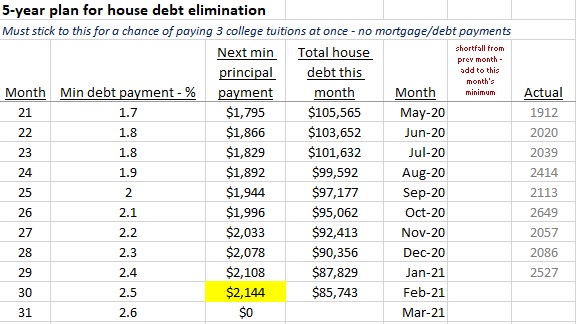

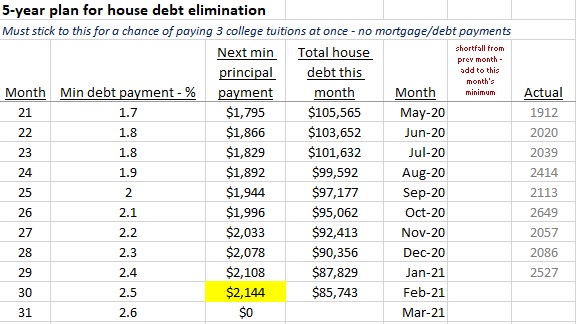

Each month I track the principal payments for our house debt. I started this to put us on an achievable schedule to pay off the house within 5 years. I’m on payment 30 of 58. It’s exciting for me to see the acceleration in principal reduction – both from larger payments and decreasing interest due.

Posted in

Debt,

Goals

|

3 Comments »

February 5th, 2021 at 07:50 pm

In the Fall of 2020 while I was working but mostly focused on Dad, the company launched its IPO. It’s the third attempt so I think that most colleagues didn’t think it’d really happen but this time it went through. The company was profiled on the NASDAQ billboard in Times Square that day with pictures of our colleagues.

How ironic that it was in 2020 – a year in which we took 10% pay cuts because the company expected to perform poorly. Instead, technology companies excelled because of the broad dependence on technology forced by the country’s extended shutdown. Our initial stock price is now double.

I haven’t heard any talk of returning our 10%, but now my stock options are worth much more than before. Many are still unvested so I can’t exercise them yet.

Every colleague also received some shares of stock just before the IPO. I appreciated the unexpected bonus but it threw a wrench into my tax planning. We will owe thousands of dollars in taxes this year partially because the stock gift caused our income to exceed the threshold for the American Opportunity credit. We lost that credit, we lost a dependent (for a good reason – he’s on his own now!), and the twins are too old now for us to get the generous child tax credit. It was good while it lasted. On the positive side, the stimulus payments were based on our 2019 situation so we did get a break in 2020 despite their being 17.

Posted in

Investing,

Personal Finance

|

2 Comments »