|

|

|

|

You are viewing: Main Page

|

|

June 30th, 2023 at 01:14 pm

My last day!

It’s also payday and I see two deposits in my account. The first one is a regular paycheck. I suspect that the second is a payment for my remaining vacation time.

I should hear from HR later today on the paperwork for my severance pay. I know that I won’t receive it for at least a week after I sign the paperwork. I think it’s related to a state law that allows backing out of a contract within a week of executing it.

Posted in

Uncategorized

|

1 Comments »

June 29th, 2023 at 01:19 pm

Two more working days! And I'm an hour into one of them.

I’ve installed (with help from DS5) my retirement gift from the company – a Sonos home speaker system. As a manager, I knew that the company provided funds for the manager of the retiring colleague to purchase a gift and I knew the budget for mine. I’ve purchased the gifts for four retirees myself when I was the manager. I usually asked the retiring colleague for their preferences. I guess that spoils the surprise element but at least they receive something they really want. I wasn’t sure how my manager would handle it so I took the initiative to tell him what I wanted. I am so glad that I did! I love having my music play throughout the house and the deck (when I put the ‘Move’ outside).

We spend lots of time on the deck during the summer so now I have music while I’m preparing the meal and also while we’re eating outside.

I’ve just been reimbursed for my last expense report. It was late so I was getting worried that it would be a lingering to-do. I’m glad to have it done.

Posted in

Retirement

|

0 Comments »

June 28th, 2023 at 12:33 pm

The number of working days left – three!

I’ve sent my ‘so long’ e-mail to colleagues that I’ve worked closely with over the years and I’m glad I did that. I’ve received many well wishes and compliments. The company’s gotten large, so often in the past I’d find out someone was gone after reaching out to them for information.

I’ve completed the COBRA paperwork. The company will pay for the first three months and I’ll pick up the premiums (or change to another plan) after that. The monthly premiums will be just under $2500. Ouch! It’s for the family but still. I’m thankful that the company pays the first few months and I do have HSA funds that can be used for the premiums. We’ll definitely stick with COBRA for 2023, and probably 2024 but I’ll do comparison shopping for 2024 before making that decision. And now, I’ll have the time for that research!

Because I have to return the printer, I purchased a new one. I’ve just done the pack-up and set-up activities related to that. I was told that I could keep the cell phone (just not the company-paid plan) but not before I purchased a new phone and plan. So my former work phone will go to DS5. He’ll be upgrading from an iphone 7 to an iphone 11. He’s excited.

I can’t pack up the laptop and monitor until I’m really finished working. And much of my days this week are in knowledge transfer sessions with others.

Posted in

Personal Finance,

Retirement

|

4 Comments »

June 11th, 2023 at 02:18 pm

I haven’t blogged in months and a couple of big financial things have happened. The exciting one is that I gave notice at work of my retirement, and it’s now 19 days away!

The company has a voluntary separation program (VSP) that sends a retiree off with a nice severance. To qualify I had to be 55+ and have the sum of my years of service to the company and my age be at least 72. I also had to provide a minimum of 3 months’ notice, which I did – plus one day. I’ve actually qualified since I was 55 but I wasn’t ready then. Now the house is paid off and I’m comfortable with living lean until my retirement account can be accessed without penalty. I have a small Roth IRA as a back-up and I’ve also read a couple of articles about accessing a 401k after 55 but before 59.5 without penalty. That’s a back-up to the back-up though – I hope I don’t need that. But just in case, I’m leaving my retirement funds in the 401k until I’m 59.5. Then I’ll roll it into an IRA where I have more control.

My job is fine – I don’t dislike it and yet, I am super excited just to wake up and feel free.

Posted in

Retirement

|

7 Comments »

January 31st, 2023 at 12:55 pm

We finally completed the long-procrastinated task of updating our wills. I’m glad to have it done though I am still working on the step-by-step guidance document for the executor. (requested by DH) That document has been a bigger chore than I expected but I’m learning a lot. In addition to online research, I bought a book that is so worth the cost: The Executor’s Guide by Mary Randolph. I also created documents for inventory of assets, final wishes, and contact information for all beneficiaries. Our previous wills had been written decades ago when we had just two children and lived in another state!

I am setting a target to review & update as needed the supporting documents annually and the will every 5 years. I am also continuing my long-term effort of simplifying our finances. The longer I live, the simpler the estate planning will become.

I’ve learned a lesson from my Mom’s death and left my jewelry and personal things to either my boys or my nieces instead of DH. My mom would be livid to know that some of her things ended up in the hands of the children of my Dad’s second wife and they sold it for cash. That will not happen to my things! Of course, I had that discussion with DH and he gets it. His mother also died first so the situation was similar.

I’ve never had a goal, and still don’t, to leave a substantial inheritance to my kids. I’ve told them this throughout the years too – that their college funding is their gift from us and that we plan to spend our remaining money to fund our own lives. We also don’t buy the boys cars, weddings, or down payments on houses. I don’t expect that to change unless we strike gold or something. If I have an unfortunate early death, they’ll benefit financially but otherwise their inheritance will likely be modest (and split 5 ways). As an example, I have a 30-year term life insurance policy that will expire in a few years. The point of that policy was to have assurance that the kids would be cared for if I died while they were young. It’s already served that purpose. Another policy is provided by my employer, but it will expire when I stop working. So no life insurance policies will likely be in place when I pass.

The good news for the kids is that we shouldn’t ever need to be financially dependent upon them. I appreciate that my parents provided that situation to my brothers and me too.

Posted in

Personal Finance,

Kids

|

2 Comments »

January 20th, 2023 at 01:33 pm

The new bank has free coin-counting for members so I took my banking bag full of change and deposited it into the new checking account: $53.07. I didn’t think so much of it was quarters! Then I used the new debit card at the grocery store to make sure it worked with no problem.

Finally, I submitted my updated direct deposit splits to the company’s payroll department that will hopefully be effective by February.

Posted in

Personal Finance

|

1 Comments »

January 16th, 2023 at 08:13 pm

I’ve had a plan for some time now to replace my big bank with a local community bank. Last week I finally did the first step: opening the account at the new bank. Now I’m setting up links to other accounts and bill pay for some things. I thought it would be efficient to just do it all at once and that has resulted in required scrutiny of all those micro-deposits institutions make to verify identity. In hindsight, it may have been better to do them one at a time.

I also activated the new debit card. Next will be to change my payroll direct deposit to use the replacement account instead of the big bank one. Then I’ll probably use the big bank account to pay taxes this year before I close that account. They’ll probably charge me some crazy high monthly fee once my direct deposit stops because that’s what big banks do. In contrast the new community bank is completely free for members over 50. No monthly fees and free checks even without direct deposit.

Like many things, it’s more effort than I’d expected, but I like that the bank is a small community one that could be a walk from my house on a good-weather day.

So now I have three banks: a credit untion, a community bank, and an online savings account (Ally).

I still can't comment on any blogs though I'm reading them. I like Rob's scooby-snack story!

Posted in

Budgeting,

Personal Finance,

Saving Money

|

0 Comments »

January 4th, 2023 at 03:02 am

I’ve been unable to comment on any blogs for some time now. I’m not sure what the issue is since I can see comments from others and nothing has changed on my end – computer, web browser, etc.

I especially appreciate Wink’s most recent blog entry. This is the year I’ve planned to retire and several unplanned potential expenses and risks of expenses have come to light. I’m determined not to fall into the ‘one more year’ rut. I think my health and happiness will improve from letting work go, even if it means that we’re living lean.

One new year’s resolution for sure: blog more often. I’ve just gotten out of the habit.

Posted in

Retirement,

Goals

|

4 Comments »

February 9th, 2022 at 02:04 pm

Our roof is nearly twenty years old and it’s time to replace it. Fortunately, we haven’t had any mishaps other than a few shingles blowing off over the years during tornados & storms. This is an expensive but necessary upgrade that I want to fund while I’m working.

I’ve just gotten four estimates that I’m now comparing. It’s tough to compare apples-to-apples since the four quotes include three different brands of shingles, different payment rules, and different workmanship warranties. I’ve been researching shingles online to attempt an informed decision. Does anyone else do this?

I have it narrowed down to two. Both are local companies. One uses a basic shingle that’s commonly used and has a 10-year workmanship warranty. From my internet search, it seems like the company has just a few employees because the reviews mention them by name. The other company uses better quality shingles and has a 12-year workmanship warranty. They have many rave reviews (Yelp, etc.) that are recent. The difference between the prices is almost $4k. ($11k vs $15k) So I need to determine how much that quality is worth to me. Hmmm.

The two estimates that I am not pursuing: One had only a 1-year workmanship warranty and the shingle brand was the lowest rated. The other used the same shingles as the lowest price but was priced $3k higher.

Posted in

Budgeting,

Goals

|

3 Comments »

February 6th, 2022 at 04:12 pm

We’ve had two home improvements projects happen in the same month after waiting months for both. The first one is a sliding barn door that allows our living room to be a makeshift bedroom. The couch in there is a sleeper sofa and there’s an armoire but before we didn’t have a good way to add privacy. I finally found a person with the availability and skills to do it and I love the door. The second project is the long-awaited cat fence. I signed that contract in May and supply issues related to the pigment required to produce the color I wanted caused the delay. It’s done now and I’m eager to have warm weather to see how it works when the cats really want to be outside.

I’ve just started our taxes. It’s going to be ugly and I expected it because I sold stock that vested last year. Once again our income level bumped us out of the Opportunity Credit and for the first time bumped us out of Roth contributions. I had been making the Roth contributions so I backed them out – ugh – to prevent penalties but then I had to pay taxes on their earnings. It’s all messy but I sure don’t want to complain about it – the stock proceeds allowed me to pay house debt and I hope to report that major milestone in about a month.

My goals for 2022:

(1) House projects - replace the roof (shingles), downstairs ceilings painted, design kitchen reno & get quotes

(2) Personal - finish the two scrapbooks for the twins by their graduation

(3) Health - get lean by implementing routines for fasting, resistance training, and yoga

(4) Financial - pay off house, get EF to 7 months’ expenses

(5) Kids - DS1: help w/ rescue cat, DS2: get to know GF, DS3: help set up investments, DS4: open Roth & transfer brokerage from minor account, DS5: support job search for semi-gap year

[so weird that some words couldn't be bolded...]

My goals have retirement preparation in mind. 17 months and counting.

Posted in

Debt,

Goals

|

4 Comments »

January 15th, 2022 at 05:15 pm

I’ve slipped out of the habit of blogging and financial things are still happening.

My paychecks are back to the normal lower level since social security and 401k contributions are again being deducted. The company for the first time in decades (and maybe ever) increased its matching contributions from 50% up to 5% of total compensation to 50% up to 6% of total compensation. I still think that’s lower than the benefits offered by some of our major competitors but I was pleasantly surprised.

I’m targeting to retire in 18 months and I have a ‘This is the home stretch!’ feeling. I want to get some home projects done that could become pricey and I want to begin transitioning the way I spend my free time. When I finalize annual goals, I’ll focus on those aspects.

Happy new year!

Posted in

Personal Finance

|

1 Comments »

November 29th, 2021 at 01:35 am

DS5 is now a licensed driver. I spent about $350 on six hours of driving lessons several months ago and it was worth it to me. With DS1 & DS2 I wasn’t so afraid to ride in the passenger seat with a driver-in-training but I am now. Relatives helped on getting driving time for him too when we visited them last month. I’m glad that we’ve got the last one over the line.

I don’t know how much the insurance will go up from adding a third teenaged boy to the policy. Yikes! I’m expecting an invoice soon.

I had an annoyance with the car insurance & our state’s DOT but fortunately it didn’t cost me money – just inconvenience. While we don’t buy cars for the boys, I am willing to have them in my name and to insure them while the boys are in school if they choose to buy a car. [And their driving record is clean.] As a result, I have four cars in my name though I drive just one of them.

DS4 decided to sell his car and buy a different one so for a short while I had five cars insured. I didn’t realize it until later when I noticed different policy numbers, but apparently only 4 cars can be on one policy so the insurance company had the fifth car on a separate policy. Then when DS4 sold the car, the newest one was moved to the original policy so all the vehicles were together again. That’s when I received a notice from the DOT that they had been informed that my policy was cancelled. I know from the experience of one of my boys that if the DOT doesn’t receive proof of insurance by the deadline, they assume that you had a lapse in coverage and they fine you $500. You can appeal it by going to court and showing proof of insurance but the appeal is $150 for court costs. Sooo, I sent my proof of insurance to the DOT by registered mail so I’d get confirmation of its receipt. I may complain to the insurance company. Why would they contact the DOT when they just changed the policy? I don’t know if it was a mistake or if they’re required to do it.

I’m enjoying the last few weeks of our CSA season. My brother and his wife gifted me a couple of boxes from Farmbox Direct for my birthday so right now we’re getting fresh organic vegetables AND fruits! Heaven.

Posted in

Personal Finance,

Health

|

1 Comments »

November 23rd, 2021 at 04:23 pm

Our gas (with fake logs) fireplace gave out last year. We were able to hire a handyman to do some tweaking to limp it along last winter while I planned to replace it this year. Replacing it became a bigger and bigger deal. No place could just replace the ‘guts’ of it. Even the mantel couldn’t stay because it would break when the fireplace was pulled out. The fireplace came with the house so it was almost 20 years old.

That meant that an upgrade that I originally thought would be a couple thousand dollars was about ten thousand dollars. And the two places that sold & installed them were booked out for months. I think it was in July when I signed the contract and the installation was finally completed yesterday. The good news is that we have it in time for cold weather and it is far (far!) superior to our older one. This one is heating the house! It has a remote control that allows us to control the flame (5 settings), the lighting, the ‘embers’ (cosmetic only), and the fan. With the fan, it blows the warm air out into our family room which is open to the kitchen. I’m in love with it.

I set aside the money for it in the online Ally savings account so it would earn interest while we waited. I paid with a credit card and will move the money into checking when the CC is due next month. I’m doing the same thing with the money set aside for the fence – contract signed in May and it looks like it’ll be 2022 before it is installed because of material supply chain issues. Another post… A picture of the new fancy fireplace:

Posted in

Personal Finance

|

3 Comments »

November 15th, 2021 at 05:24 pm

Well, it turns out that it wasn’t Weis where I earned the free turkey certificate. It was Giant. And I discovered this because I tried to redeem it at Weis! Yikes, embarrassing. But I did get the turkey and it was indeed free. A 20-pounder. Since the boys selected other meats for Thanksgiving Day (The choice is our tradition.), we’ll be cooking the big bird in the next few days. DH is the meat cooker so this is all him.

Posted in

Saving Money

|

3 Comments »

November 12th, 2021 at 02:40 pm

I have completed my Christmas shopping – even stocking stuffers. Never in my life have I accomplished this before Thanksgiving. The news of supply chain issues and potential shortages gave me a sense of urgency I guess. But it feels good to be able to enjoy the time now.

We will still have expenses for a tree and our traditional Christmas Day seafood gumbo ingredients. Maybe we’ll get a couple of gingerbread house kits this year too. The boys used to decorate them and then we would gift the best-looking ones to select neighbors.

Posted in

Budgeting

|

3 Comments »

November 10th, 2021 at 03:36 pm

As mentioned in a previous post (2020) I have a deadline set for the start of my retirement. And I have a list of prerequisites to determine whether I’m in a safe-enough-for-me position to retire sooner. Each quarter I evaluate my progress against those prerequisites, and my quarterly check-in for this is aligned with my birthday instead of the standard calendar quarter. That’s because a couple of my prerequisites are based on my 60th birthday so the calculation is simpler.

Result for this check-in: I’m slowly getting closer! I’m now planning to pull the trigger in 2023 ahead of my original target of 2025.

In order to pull the plug immediately, I’d have to have these things accomplished:

++ Retirement account on target for 7 figures by 60th birthday

++ College savings on target for full funding

++ Mortgage paid off

++ Savings of basic expenses until 60th birthday set aside

++ No consumer debt

Currently my progress is:

++ 100+%

++ 57.5%

++ 76.5%

++ 14.7%

++ 100%

Assumptions for these calculations: average annual return on investments will be 5%, no further contributions to investments, full funding = 40 semesters (8 x 5 boys), $36,000k annually for basic expenses, starting consumer debt was $10k.

College for the twins may be cheaper because they both are planning to start at the local community college but I’m keeping assumptions the same so I’m comparing apples to apples each quarter.

Posted in

Uncategorized

|

1 Comments »

November 9th, 2021 at 06:51 pm

We traveled south last month to celebrate my Dad’s milestone birthday with him. It was special because a year ago we hoped and prayed but didn’t expect that he’d live to see this one. My brothers and I hosted a surprise party at a nice restaurant and it was indeed a surprise. Everything turned out perfectly. My share was about $450. Worth. Every. Penny.

The boys still attended school each weekday morning while we were gone since they’re in cyber school. I had the other half of my amalgam fillings replaced while we were there with the dentist who did the first half. I bought an annual subscription with that dentist to keep the price lower for my dental work. I may need to cancel it within the next few months so it doesn’t auto-renew. I don’t remember if that was a default in their contract. No sense in having a dentist more than a thousand miles away!

I’m so glad we traveled before American Airlines started cancelling flights. That would have been awful. I’m happy to say that our travel was uneventful.

Posted in

Budgeting

|

0 Comments »

November 8th, 2021 at 02:55 pm

I know it’s my age/generation but whenever I hear anything about cryptocurrency, it seems like fake money to me. I don’t get it. And I do realize that our paper money is no longer backed by precious metals so in effect its value is debatable too. I admit that I’m an old fogie in this area.

So recently DS2 installed something on DS5’s computer that earns cryptocurrency. The best I can understand after asking for an explanation is that DS5’s graphics card is being rented out for processing power when he isn’t using it. He’s making the equivalent of $2/day by having his computer run this. That piqued my interest. DS2 has his computer set up with multiple graphics cards connected to a single motherboard and he’s making a few hundred dollars a month while he’s at his real mechanical engineering job. That’s wild to me. He occasionally converts the crypto to dollars and transfers them to his bank account. Apparently the only gotcha is that you have to have a quality graphics card and they’re hard to come by now because lots of people are doing this. I assume that all that processing uses some electricity too.

I just find it interesting that young adults have discovered an automated income stream. Kids today!

Life of leisure Life of leisure

Posted in

Personal Finance,

Kids

|

5 Comments »

November 7th, 2021 at 12:02 am

We’re in the open enrollment period for benefits at work. I was happy to see that my share of the health insurance premiums will not increase in 2022. Both the 401k maximum contribution and the HSA maximum contribution will increase by $1000 so that’ll be about $170/month in additional deductions. I get paid twice each month so it won’t be too noticeable.

DS1 is no longer on my insurance since he turned 26 in 2021. It was a little sad seeing “coverage terminated” by his name but of course it’s a good thing – he’s completely on his own. DS2 is on his own as well but still on the insurance to save money. It doesn’t cost me any more to keep him on and his employer would require that he pay a premium for their insurance. He’ll be able to do that for a couple more years.

In other financial news, DS4 & DS5 turned 18 recently so I no longer pay allowance – to anyone. Woohoo! That’s like a raise. With my progressive rate allowance system, they were each costing me $34/week.

Posted in

Budgeting

|

2 Comments »

October 8th, 2021 at 03:31 pm

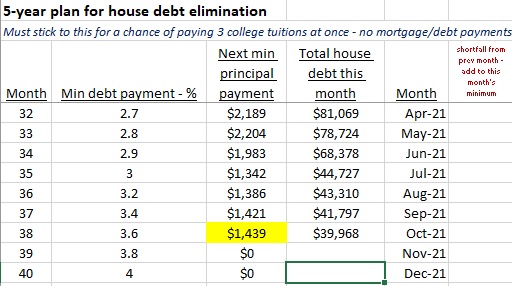

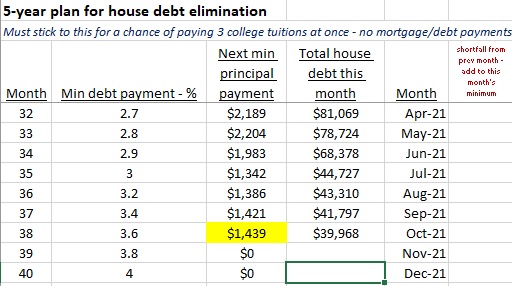

A minor milestone - the house debt is now below $40k.

If I stick to my plan it’ll be paid off in June 2023. I’m seriously considering selling some company stock in 2022 to just be done with it. It’s a focus for me because it’s our only debt. The credit card debt is there but it’s paid in full when it’s due.

Posted in

Debt,

Goals

|

3 Comments »

September 6th, 2021 at 04:17 pm

A recent post in an online neighborhood app touched me and as a result we have three more felines. Making a total of five plus a dog. It’s not a frugal move!

The woman who needed to rehome them is terminally ill and nearing the end. She doesn’t have a husband, children, or siblings. It’s very sad for her – having to let go of her pets but knowing that it needs to be done. It’s traumatic for the cats too – I’m being very patient with them as they get accustomed to their new home. So far they are living in the master suite only.

DH says that I’m now an official crazy cat lady. I’m okay with that.

Posted in

Personal Finance

|

8 Comments »

August 7th, 2021 at 12:43 am

I mentioned in a previous post (2020) that I have a deadline set for the start of my retirement. And that I have a list of prerequisites to determine whether I’m in a safe-enough-for-me position to retire sooner. Each quarter I evaluate my progress against those prerequisites, and my quarterly check-in for this is aligned with my birthday instead of the standard calendar quarter. That’s because a couple of my prerequisites are based on my 60th birthday so the calculation is simpler.

Result for this check-in: I’m getting closer! I’m hoping to pull the trigger in a couple of years.

Currently my progress is:

Retirement account on target for 7 figures on 60th birthday: 100+%

College savings on target for full funding: 55%

Mortgage paid off: 73%

Savings of basic expenses until 60th birthday set aside: 14.4%

No consumer debt: 100%

Assumptions for these calculations: average annual return on investments will be 5%, no further contributions to investments, full funding = 40 semesters (8 x 5 boys), $36,000k annually for basic expenses, starting consumer debt was $10k.

The next time I check-in on this progress will be around my birthday.

Wow - I really struggled to get the formatting for this post to include all the content and not look wonky...

Posted in

Retirement,

Goals

|

1 Comments »

August 3rd, 2021 at 10:41 pm

Businesses in our area have been struggling to maintain staffing. I assume that it’s related to the stimulus package(s). Some have restricted their business hours or their offerings in response to the shortage. Some of the fast food restaurants just close for the day when enough workers don’t show up. It’s sad. But – it’s been a help to teenagers that are off for the summer and want to make some money, including ours.

DS4 kept his lifeguard job and got a pay increase this year. DS3 got a surprisingly high-paying job at an Amazon warehouse. DS5 got his first ever job at Burger King. It’s been a great learning experience for him. He’s learned about using cash registers, customer service, and of course making (unhealthy) food. The boys were required to take a career education class earlier in high school and one assignment was drafting a resume. Poor DS5 had no job experience, no volunteer work – pretty much a blank page with LARGE font to make up for the lack of content. It was a wake-up call. Now’s he’s done a cool volunteer project offered at school and gotten his first job.

Posted in

Education,

Kids

|

3 Comments »

August 3rd, 2021 at 01:14 am

I’ve been back home since the middle of April and just haven’t gotten back in the habit of blogging. There was quite a bit to do to get the house back in order and my office set up. And catch up to do with neighbors and friends after being away for months. During the time I was gone, two people that were part of my regular routine died – not friends exactly, but folks I chatted with regularly in the neighborhood and the grocery store. That discovery put a damper on last week.

At work it’s like I never left. Finances are trucking along. The company stock has been a huge help with that.

This post is to push me back into the habit. I’ll blog on particular topics in the upcoming days. I need to organize my thoughts.

Boy Scout camp Boy Scout camp

Posted in

Personal Finance

|

2 Comments »

March 30th, 2021 at 07:09 pm

Tomorrow we move back to Dad’s house and a week and a half later, we head home. Then I return to work. Change will be the norm for the next couple of weeks.

Our annual egg hunt will include only two of the five boys but the addition of three cousins this year, and it’ll be at Dad’s house. I mailed each of the three boys at home a consolation prize. I paid just as much for the shipping as the value of the contents. It was a case where the sentimental value made the shipping cost worth it. (around $20 each)

Half my amalgam fillings are replaced now and the other half scheduled for the Fall. I met with the dentist here this morning to review sleep study results and to do an entire head scan. The information that can be gleaned from the tests about my breathing and potential health conditions is surprising to me. I found it interesting.

I spent over $100 buying books and CDs related to the boys' classes and calculators with trig functions since they left theirs at home. 'Educational' budget line item.

Posted in

Education,

Health,

Kids

|

1 Comments »

March 23rd, 2021 at 03:12 pm

I hadn’t had my teeth cleaned in more than a year thanks to Covid so I decided to make a dentist appointment here instead of waiting to return home. In line with my intentions to move to holistic healthcare providers, I searched for a holistic dentist here. Since it’s a large city there are many more options here than at home.

Last week I went to my appointment and there I made the decision to have my old fillings with mercury replaced with a healthier alternative. This dental practice has all the expertise and equipment to do it safely. Half my mouth will be done this week and the other half in 6 months or so. I’ll coordinate that dental visit with a trip to see Dad, maybe for his birthday this Fall. It’s not going to be cheap but I’ve been contemplating this health improvement for a few years. The cost will be slightly more than $1000 per side so $2000 total.

I was impressed with the dental office. They have their own clean water system and clean air system and everything is high-tech and online. Such a contrast to my dentist at home who I like a lot BTW. It’s time though to make a move – I think he’ll be retiring soon. So next on my action list is to find a holistic dentist nearish to home.

Posted in

Health

|

2 Comments »

March 22nd, 2021 at 06:08 pm

I redeem credit card points for gift cards as soon as I’ve earned enough to qualify for one. This month I chose a Lowe’s gift card for the $50 reward. I’m sure we’ll use it this spring for yard work or a home repair.

Posted in

Personal Finance

|

1 Comments »

March 20th, 2021 at 06:19 pm

As hoped, we received a stimulus payment based on our 2019 AGI since we haven’t filed our 2020 taxes yet. The $2100 is a pleasant surprise and will be used to pay for our annual CSA membership and the travel costs of returning home next month.

Posted in

Budgeting,

Personal Finance

|

1 Comments »

March 15th, 2021 at 08:02 pm

The closing for the SC land sale occurred at the end of last week. UPS delivered a check with my proceeds this morning and within an hour I deposited it into my account with mobile banking and paid the 0% interest credit card in full online. Done!! Now we only have house debt.

Posted in

Debt,

Goals

|

1 Comments »

March 12th, 2021 at 02:24 pm

I started replacing some things before they failed several years ago. Like water heaters and car batteries. The kind of things that will certainly fail at a time that’s inconvenient and possibly risky. It may be a little more expensive to replace an item prematurely but that beats being inconvenienced when it eventually fails.

The newest (2010) car’s battery just got us though. We bought it used about a year and a half ago so I didn’t know how old the battery was. Because we weren’t sure it was the battery, it was taken to the shop. Now we’ll pay for a new battery and labor. Not next time though. I will place a tickler on the online family calendar to replace this battery at the end of its warranty.

Battery cost with labor: $198

Posted in

Personal Finance

|

0 Comments »

|