|

|

|

Viewing the 'Debt' Category

February 6th, 2022 at 04:12 pm

We’ve had two home improvements projects happen in the same month after waiting months for both. The first one is a sliding barn door that allows our living room to be a makeshift bedroom. The couch in there is a sleeper sofa and there’s an armoire but before we didn’t have a good way to add privacy. I finally found a person with the availability and skills to do it and I love the door. The second project is the long-awaited cat fence. I signed that contract in May and supply issues related to the pigment required to produce the color I wanted caused the delay. It’s done now and I’m eager to have warm weather to see how it works when the cats really want to be outside.

I’ve just started our taxes. It’s going to be ugly and I expected it because I sold stock that vested last year. Once again our income level bumped us out of the Opportunity Credit and for the first time bumped us out of Roth contributions. I had been making the Roth contributions so I backed them out – ugh – to prevent penalties but then I had to pay taxes on their earnings. It’s all messy but I sure don’t want to complain about it – the stock proceeds allowed me to pay house debt and I hope to report that major milestone in about a month.

My goals for 2022:

(1) House projects - replace the roof (shingles), downstairs ceilings painted, design kitchen reno & get quotes

(2) Personal - finish the two scrapbooks for the twins by their graduation

(3) Health - get lean by implementing routines for fasting, resistance training, and yoga

(4) Financial - pay off house, get EF to 7 months’ expenses

(5) Kids - DS1: help w/ rescue cat, DS2: get to know GF, DS3: help set up investments, DS4: open Roth & transfer brokerage from minor account, DS5: support job search for semi-gap year

[so weird that some words couldn't be bolded...]

My goals have retirement preparation in mind. 17 months and counting.

Posted in

Debt,

Goals

|

4 Comments »

October 8th, 2021 at 03:31 pm

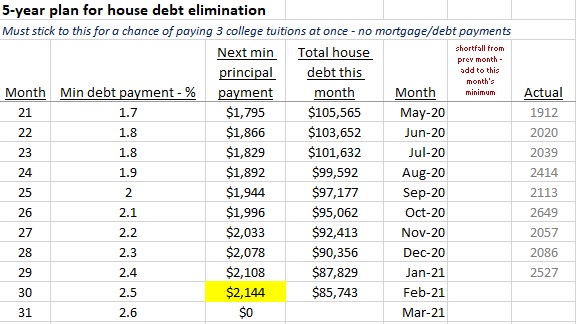

A minor milestone - the house debt is now below $40k.

If I stick to my plan it’ll be paid off in June 2023. I’m seriously considering selling some company stock in 2022 to just be done with it. It’s a focus for me because it’s our only debt. The credit card debt is there but it’s paid in full when it’s due.

Posted in

Debt,

Goals

|

3 Comments »

March 15th, 2021 at 08:02 pm

The closing for the SC land sale occurred at the end of last week. UPS delivered a check with my proceeds this morning and within an hour I deposited it into my account with mobile banking and paid the 0% interest credit card in full online. Done!! Now we only have house debt.

Posted in

Debt,

Goals

|

1 Comments »

March 5th, 2021 at 01:32 pm

In 2009 when my Grandma died, she owned a piece of land that she’d inherited from a childless sibling. We didn’t realize that she had it because she’d never mentioned it or used it. The South Carolina land is bounded by train tracks on one side and has huge power lines running over it. My brothers and I inherited the land and decided to keep it. We paid the property taxes each year but we haven’t done anything with it either. After a brief conversation with them two weeks ago, my brother put an ad on Facebook Marketplace. Within a few hours, we had offers! It turns out that the little town is growing and despite features that I would consider undesirable, the 3-acre lot was attractive to several businessmen.

We accepted an offer and have just completed paperwork to have the closing done without us in attendance. My third of the proceeds will be about $8000. Unexpected money is always nice and I know exactly what I will do with it. I will pay off the 0% interest credit card that expires next month where I have $7400 of debt parked. I feel fortunate that it’s just enough to pay it completely without touching savings and that I don’t need to look for any more 0% CC offers.

Posted in

Debt,

Personal Finance

|

0 Comments »

February 11th, 2021 at 08:07 pm

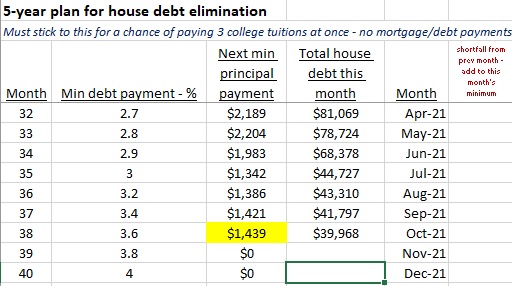

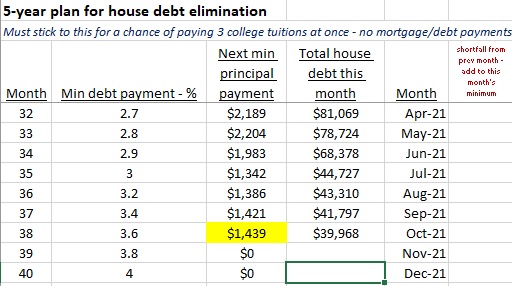

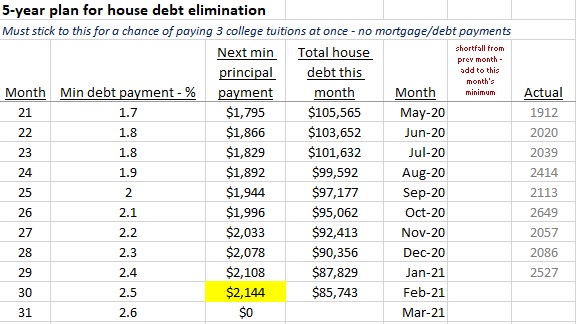

Each month I track the principal payments for our house debt. I started this to put us on an achievable schedule to pay off the house within 5 years. I’m on payment 30 of 58. It’s exciting for me to see the acceleration in principal reduction – both from larger payments and decreasing interest due.

Posted in

Debt,

Goals

|

3 Comments »

August 5th, 2020 at 12:02 pm

I’ve shared before that I track the principal payments for our house debt each month. Well this month something exciting happened – the debt dropped down to 5 digits. I’ve still got a long way to go, but it’s motivating to see that progress milestone.

5 figures!

It’s also about 2 years into my 5-year plan so hopefully I can stay on course. To do that will require a progressively increasing principal payment.

Posted in

Debt

|

3 Comments »

July 17th, 2020 at 08:15 pm

I got a marketing flyer from my credit union for home loans about a month ago. The rate to refinance was lower than my current rate with PNC and there were no fees or closing costs. It seemed like a no-brainer. After seeing Amber’s success in refinancing, I was inspired to follow-up.

I talked with the representative to verify the no costs, including no prepayment penalties, and then gave them to go-ahead to move forward. The paperwork arrived a few days later and I read the fine print. I saw a gotcha. They assumed that the homeowner’s insurance had a low deductible. I deliberately have a high deductible because I figure that’s what EFs are meant to cover. It keeps my premiums lower. I called to see if that requirement was negotiable and unfortunately it wasn’t. I asked them to trash the application. It’s not worth saving money in one place only to spend it in another.

Posted in

Debt,

Personal Finance

|

2 Comments »

June 30th, 2020 at 01:45 pm

A few years ago, I read a financial article, book, or blog (I can’t remember unfortunately.) that had an impact on how I prepare for retirement.

Before then I had just focused on a number to achieve for my retirement account – one that would support a ‘retirement phase’ budget with a 4% annual withdrawal. My thought, like many others, was that my retirement date would be the day I achieved that number. I could project that date but not count on it. The article made me rethink the approach and instead think more about my remaining time and its value. So, make the DATE the goal, not the AMOUNT. After reading, I decided to set a deadline for my retirement start date and then work to make that happen. There’s a mental shift, at least for me, in having a “deadline” instead of a “target date”. A target is something that I work toward and hope it works out, but know it might not and that’s okay. A deadline on the other hand is something I work toward with some sense of urgency because if it doesn’t work out, I have to resort to a back-up plan that isn’t as nice. When I have a deadline, I tend to make sacrifices earlier if necessary so I won’t miss it.

June 30, 2025 is my retirement start deadline. I will be retired on that day. It makes me excited just to type that! That makes today a milestone – my retirement is a maximum of 5 years from today. What if I don’t have the magic number in the retirement account? Then I will adjust my retirement lifestyle, but I will not change the date. One thing that has reinforced my view has been this site, where I see several of you in retirement living quite well without a huge nest egg. There are so many accounts too of people who had a sudden disability that resulted in that date being selected for them and they weren’t prepared. And others who achieved their magic number but have the ‘one more year’ syndrome for several years because they worry about the potential flaws in their calculations. I also encountered one of those Monte Carlo simulators that included the probability of being dead along with the probabilities of being broke or wealthy. That drove home the concept to me: I want to control how I spend the rest of my life.

2025 is the year I turn sixty. I can access my retirement account without penalty then. I won’t qualify for Medicare yet. My youngest boys won’t be finished with college. All those factors are included in my planning.

I set a list of prerequisites that must be met if I voluntarily opt to retire before June 30, 2025. In order to allow myself to retire earlier, I have to have these things accomplished:

(1) Retirement account on target for 7 figures on 60th birthday

(2) College savings on target for full funding

(3) Mortgage paid off

(4) Savings of basic expenses until 60th birthday set aside

(5) No consumer debt

I track my progress against those prerequisites each quarter. I have a timeanddate.com countdown set too – today I have 260 more Mondays until my deadline.

Posted in

Debt,

Retirement,

Goals

|

6 Comments »

April 17th, 2020 at 11:09 am

I put the stimulus payment to good use – the balance on the 0% CC expiring in May is history. Woohoo! That means that my annual goal #4 - pay no CC interest or fees – will be achieved so long as I don’t take on additional CC debt this year.

I’ll close the CC in the next few days. I don’t need the credit since I have another card with rewards for everyday purchases. Next focus for unallocated funds is the EF: annual goal #1 - get EF back to 3 months’ basic expenses.

Our dog found two more eggs in the yard yesterday! One just had Skittles but the other had a dollar bill.

Posted in

Debt,

Goals

|

4 Comments »

March 19th, 2020 at 02:09 pm

I was beginning to think our state delayed the payment of income tax refunds because it’s been about a month and a half since our taxes were filed online. But this morning I see that the state refund is direct deposited in the bank account. As planned I directed it to the 0% CC that needs to be repaid by May. The remaining balance now is $2130.

Posted in

Debt

|

1 Comments »

March 3rd, 2020 at 02:44 pm

Today was the day for my monthly net worth calculation. I time it each month to be just after the automated house payments. I expected ugliness so I actually was almost pleasantly surprised. I’m down $24k since last month. The retirement accounts did take a brutal beating but it was countered by the company stock price increase, house value increase, and debt payoff. The company is private and the stock price is evaluated only twice per year. That happened last month so the impact of the volatile market isn’t reflected in the price yet.

As much as I know that it’s risky to try to time the market, the three days of huge losses was too tempting. I spent a few thousand of funds in the money market to buy more index funds. (all within the retirement account). I must not have been unique in that thinking given the big gains yesterday. I don’t regret doing it since the (much) lower value of the account overall made the cash position a little lopsided.

In other financial news, DS2 just received an unexpected scholarship. It was $1500 so with our split arrangement that’s $750 for me. I had money set aside for his food costs for the remainder of the semester so I’m redirecting that money to the 0% CC to be repaid by May. The balance on that card will now be $4900.

Posted in

Debt,

Investing,

Personal Finance,

Retirement

|

1 Comments »

February 20th, 2020 at 03:37 pm

My 2020 goal #4 is “Pay no CC interest or fees”.

Since I have a balance on a 0% card that expires in May, I’ve decided to do a combination of paying it off and transferring to another 0% card with no fee involved. I applied for a Bank of America card (I mentioned it on Amber’s blog earlier.) that has a 0% rate with no fees for balance transfers before mid-March. It was approved and they just completed the balance transfer.

The original total amount parked on the 0% CC was $19k. I transferred $10 of that, leaving me to pay $9 right away. I used the federal refund toward the balance; I will use the smaller state refund toward it; I used a portion of my quarterly bonus; Now I am diverting amounts from regular pay between now and May. I should get ‘er done.

I will likely just pay the minimums to BoA each month while I focus on other goals. My next focus is the EF. Then later in the year I’ll make a plan for what’s remaining on the BoA card. Its 0% special expires in April 2021.

Posted in

Debt,

Goals

|

4 Comments »

February 12th, 2020 at 02:23 pm

I know the media makes more money when they sensationalize, but I still get concerned when I see articles like this one posted yesterday on Yahoo Finance: U.S. Household Debt Exceeds $14 Trillion for the First Time

This chart of household debt from the article is interesting. It looks like CC debt is actually declining but student loan debt is multiplying. And auto loans haven’t wavered in popularity.

Link to article: https://finance.yahoo.com/news/u-household-debt-exceeds-14-160303784.html

Posted in

Debt

|

3 Comments »

February 6th, 2020 at 06:15 pm

Mostly out of fear for our upcoming college expenses over the next half dozen years, I made a plan over a year ago to get our house debt paid. Our house debt is a combination of a mortgage and a HELOC. The mortgage interest rate is 3.49%. The HELOC rate, which can change, is 5.64%. So every extra principal payment I make goes to the HELOC.

In order to make it doable when I started, and also to use a method where one bad month couldn’t blow it for me, I created a schedule with defined percentages instead of dollar amounts. The percentages increase over the course of time as I should be able to find additional money to throw at the debt. As you can see (I have to get the photos to work for this post!), I need to come up with $1779 worth of principal payments this month including my regular scheduled payment. That shouldn’t be a problem. But next month, I have another percentage increase.

Only people on sites like this would understand these games that motivate me to do the right thing!

Posted in

Debt,

Goals

|

2 Comments »

February 1st, 2020 at 06:38 pm

For our family January ended on a sad note: FIL died yesterday. He was in hospice so it wasn’t unexpected but still tough to accept.

Yesterday was my fast day too (new habit – one of my 2020 goals) and I survived. Going for two days to get my February day in too was not an option though – 24 hours was as much as I could take. So I’ll plan for another day in February. And I’ve got to decide what my second new health-enhancing habit will be beginning this month.

On the financial front (since that’s the focus of the blog!), DS4 had an interview today for a summer job. He feels good about it. He was nervous but prepared. I’m really proud of him, no matter what happens. Hopefully he’ll get an offer after they check his references.

I’ve stopped using the Ally CC and I’ll redeem my points for cash to the online savings account once my last purchase moves from ‘pending’ – a nearly $300 vet bill for our feline’s annual check-up. Then I’ll be done with that account.

I’ve started doing taxes and hope to finish them within a few days. And I’ve sent principal payments to the 0% CC with a balance and to house debt. I’ve also just been reimbursed for my business trip earlier in the month so I need to send that to the CC before it’s due.

Posted in

Debt,

Health,

Goals,

Kids

|

11 Comments »

|