|

|

|

Viewing the 'Goals' Category

June 5th, 2025 at 05:02 pm

Like DisneySteve and LuckyRobin, I also have an upcoming renovation. It’s our kitchen & laundry areas which are adjacent. We’ve been in this house for over 20 years and I’ve waited so long for this day!

Our current start date for the physical work is June 20th. On that day there will be a dumpster in the driveway and the demolition of the current kitchen will be underway. But I wouldn’t call that our ‘start’ date. I have spent the past several months designing the kitchen, then my contractor came over and walked through the project with me in early April. He had a couple of great ideas that generated some minor changes to the design. Then he worked a quote and following that I drew the final plan and submitted the application to the township for the building permit. The permit was approved about a week or so ago so we signed the contract and set the start day for the work. Because the cabinets I’m using have a long lead time, we actually ordered them before I even had the quote. I had to pay half upfront to order them too. That’s how trusting my relationship is with my contractor. This is our 5th project with him (and the largest one). He wrote the quote knowing that he would be awarded the project and I was okay with that.

Since this is a financial site, I’ll plan to share my costs as the project proceeds because I know that’s of interest here. So far, this is what I’ve spent:

$24,000.00 cabinets (2 of 2 payments included)

$12,233.00 initial labor payment

$309.50 building permit (admin & inspection charges)

$570.28 new laundry door (will be picked up by contractor)

So, $37,112.78 and work hasn’t even begun!

I should mention too that there are two far corners of the kitchen that are already done. I was able to have those done as smaller separate projects and it allowed us to live with the cabinet style, backsplash, and countertop for a couple of years before putting it throughout the kitchen. I used the same contractor for those projects.

Following are before & after photos of the 2023 kitchen corner #1 project. It was taking an empty wall section and turning it into a beverage station for our water filter and coffee machines. I still love it.

Posted in

Personal Finance,

Retirement,

Goals

|

7 Comments »

December 16th, 2024 at 06:55 pm

This historically has been the time of year that I plan for upcoming financial goals in the new year. It’s a different perspective now that I’m retired and not contributing to accounts. Of course, I hope to see some growth but it’s almost completely out of my control. So, my planning is about managing money rather than growing it.

2025 is a milestone year for me financially because I will turn 59 ½. I’ve kept my 401k account open since I retired just in case I needed to tap it before I turned 59 ½. I don’t know the rules but saved a link to an informative site about withdrawing money from a 401k without penalty after age 55. I shouldn’t need to do that now though as I believe I have enough to last me until that milestone. I will want to move the entire balance of the account into a self-directed IRA. So that’s a focus this year – researching low-cost companies (Schwab, Fidelity, Vanguard, etc.) as well as researching the mechanics of doing it. It’s a little scary. I hope I can get good, maybe even in-person, customer service.

2025 will also be the year that I have the kitchen remodel completed. I’ve done two corners of the kitchen in phases – the first in 2023 and the second in 2024. The rest, which will be expensive and take much more time, will be done in 2025. I’m excited about this but nervous about the huge cost. I’ll spend a good bit of time during the first part of the year designing the layout in detail. I want to think of every item that needs to be stored and every task I commonly do in the kitchen. I already have the basics decided. I’ll also need to find out about the building permit application process.

As some may recall, I have a deal with my boys to split any scholarships they get for college with them. DS3 is in a special situation because the military is covering his college costs while he works in the day and remotely takes his courses at night. He and I negotiated a $15k gift at graduation in lieu of matches since his isn’t really a ‘scholarship’. There is a possibility that he will graduate in 2025 if he maintains a heavy school load. I need to be prepared to pay.

I’ve taken advantage of the health exchange for insurance beginning in January 2024. I could have kept Cobra coverage for 12 more months but it didn’t make financial sense. I’ve just signed us up for the same coverage in 2025. This will be the first year I do income taxes that take the generous subsidies into consideration. Even though I followed all the rules, a part of me is nervous that there will be some gotcha and that I’ll owe money to the state. I’m looking forward to getting our taxes done so I don’t worry about it any longer. The plan is to stay on the health exchange (provided that it remains in place) until we qualify for Medicare.

My non-financial goal for 2025 is to do an unassisted pull-up on my 60th birthday. I have never in my life done one. It’s a serious goal though and I’ve begun preparing for it. If I don’t succeed, at least I’ll be stronger and healthier!

Posted in

Education,

Retirement,

Health,

Goals

|

8 Comments »

January 4th, 2023 at 03:02 am

I’ve been unable to comment on any blogs for some time now. I’m not sure what the issue is since I can see comments from others and nothing has changed on my end – computer, web browser, etc.

I especially appreciate Wink’s most recent blog entry. This is the year I’ve planned to retire and several unplanned potential expenses and risks of expenses have come to light. I’m determined not to fall into the ‘one more year’ rut. I think my health and happiness will improve from letting work go, even if it means that we’re living lean.

One new year’s resolution for sure: blog more often. I’ve just gotten out of the habit.

Posted in

Retirement,

Goals

|

4 Comments »

February 9th, 2022 at 02:04 pm

Our roof is nearly twenty years old and it’s time to replace it. Fortunately, we haven’t had any mishaps other than a few shingles blowing off over the years during tornados & storms. This is an expensive but necessary upgrade that I want to fund while I’m working.

I’ve just gotten four estimates that I’m now comparing. It’s tough to compare apples-to-apples since the four quotes include three different brands of shingles, different payment rules, and different workmanship warranties. I’ve been researching shingles online to attempt an informed decision. Does anyone else do this?

I have it narrowed down to two. Both are local companies. One uses a basic shingle that’s commonly used and has a 10-year workmanship warranty. From my internet search, it seems like the company has just a few employees because the reviews mention them by name. The other company uses better quality shingles and has a 12-year workmanship warranty. They have many rave reviews (Yelp, etc.) that are recent. The difference between the prices is almost $4k. ($11k vs $15k) So I need to determine how much that quality is worth to me. Hmmm.

The two estimates that I am not pursuing: One had only a 1-year workmanship warranty and the shingle brand was the lowest rated. The other used the same shingles as the lowest price but was priced $3k higher.

Posted in

Budgeting,

Goals

|

3 Comments »

February 6th, 2022 at 04:12 pm

We’ve had two home improvements projects happen in the same month after waiting months for both. The first one is a sliding barn door that allows our living room to be a makeshift bedroom. The couch in there is a sleeper sofa and there’s an armoire but before we didn’t have a good way to add privacy. I finally found a person with the availability and skills to do it and I love the door. The second project is the long-awaited cat fence. I signed that contract in May and supply issues related to the pigment required to produce the color I wanted caused the delay. It’s done now and I’m eager to have warm weather to see how it works when the cats really want to be outside.

I’ve just started our taxes. It’s going to be ugly and I expected it because I sold stock that vested last year. Once again our income level bumped us out of the Opportunity Credit and for the first time bumped us out of Roth contributions. I had been making the Roth contributions so I backed them out – ugh – to prevent penalties but then I had to pay taxes on their earnings. It’s all messy but I sure don’t want to complain about it – the stock proceeds allowed me to pay house debt and I hope to report that major milestone in about a month.

My goals for 2022:

(1) House projects - replace the roof (shingles), downstairs ceilings painted, design kitchen reno & get quotes

(2) Personal - finish the two scrapbooks for the twins by their graduation

(3) Health - get lean by implementing routines for fasting, resistance training, and yoga

(4) Financial - pay off house, get EF to 7 months’ expenses

(5) Kids - DS1: help w/ rescue cat, DS2: get to know GF, DS3: help set up investments, DS4: open Roth & transfer brokerage from minor account, DS5: support job search for semi-gap year

[so weird that some words couldn't be bolded...]

My goals have retirement preparation in mind. 17 months and counting.

Posted in

Debt,

Goals

|

4 Comments »

October 8th, 2021 at 03:31 pm

A minor milestone - the house debt is now below $40k.

If I stick to my plan it’ll be paid off in June 2023. I’m seriously considering selling some company stock in 2022 to just be done with it. It’s a focus for me because it’s our only debt. The credit card debt is there but it’s paid in full when it’s due.

Posted in

Debt,

Goals

|

3 Comments »

August 7th, 2021 at 12:43 am

I mentioned in a previous post (2020) that I have a deadline set for the start of my retirement. And that I have a list of prerequisites to determine whether I’m in a safe-enough-for-me position to retire sooner. Each quarter I evaluate my progress against those prerequisites, and my quarterly check-in for this is aligned with my birthday instead of the standard calendar quarter. That’s because a couple of my prerequisites are based on my 60th birthday so the calculation is simpler.

Result for this check-in: I’m getting closer! I’m hoping to pull the trigger in a couple of years.

Currently my progress is:

Retirement account on target for 7 figures on 60th birthday: 100+%

College savings on target for full funding: 55%

Mortgage paid off: 73%

Savings of basic expenses until 60th birthday set aside: 14.4%

No consumer debt: 100%

Assumptions for these calculations: average annual return on investments will be 5%, no further contributions to investments, full funding = 40 semesters (8 x 5 boys), $36,000k annually for basic expenses, starting consumer debt was $10k.

The next time I check-in on this progress will be around my birthday.

Wow - I really struggled to get the formatting for this post to include all the content and not look wonky...

Posted in

Retirement,

Goals

|

1 Comments »

March 15th, 2021 at 08:02 pm

The closing for the SC land sale occurred at the end of last week. UPS delivered a check with my proceeds this morning and within an hour I deposited it into my account with mobile banking and paid the 0% interest credit card in full online. Done!! Now we only have house debt.

Posted in

Debt,

Goals

|

1 Comments »

February 12th, 2021 at 02:35 pm

I have a deadline set for the start of my retirement and I have a list of prerequisites to determine whether I’m in a safe-enough-for-me position to retire sooner. Each quarter I evaluate my progress against those prerequisites, and my quarterly check-in for this is aligned with my birthday instead of the standard calendar quarter. That’s because a couple of my prerequisites are based on my 60th birthday so the calculation is simpler.

Result for this check-in: Again, it's not time to retire now, but I’m continuing to make good progress.

In order to pull the plug immediately, I’d have to have these things accomplished:

Retirement account on target for 7 figures on 60th birthday

College savings on target for full funding

Mortgage paid off

Savings of basic expenses until 60th birthday set aside

No consumer debt

Currently my progress is:

100+%

54%

48%

8%

25%

Assumptions for these calculations: average annual return on investments will be 5%, no further contributions to investments, full funding = 40 semesters (8 x 5 boys), $36,000k annually for basic expenses, starting consumer debt was $10k. (At one time I had negative progress on this! For the record though, it’s at 0% interest.)

The next time I check-in on this progress will be in May at my half-birthday.

Posted in

Retirement,

Goals

|

2 Comments »

February 11th, 2021 at 08:07 pm

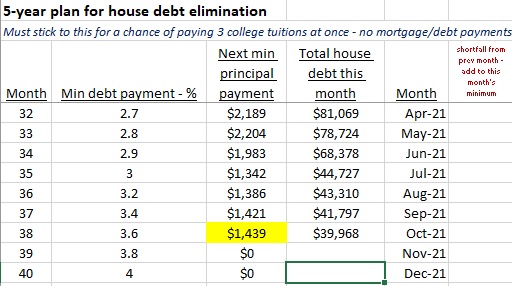

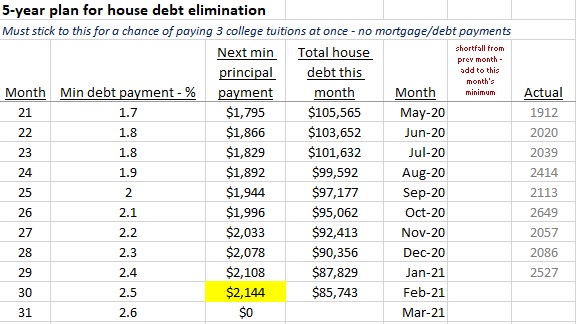

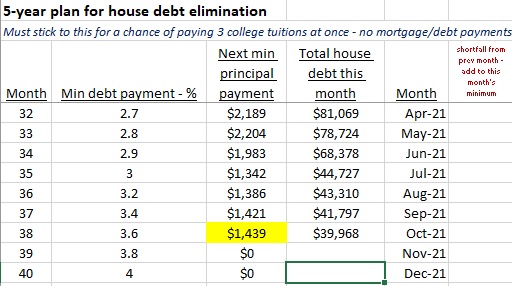

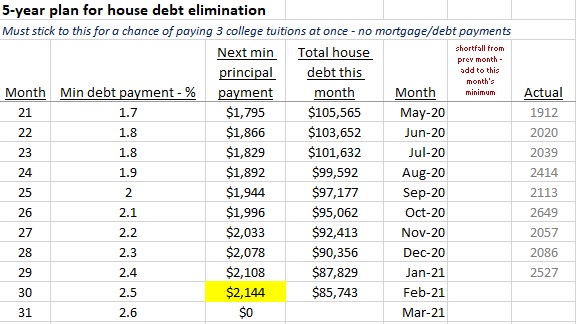

Each month I track the principal payments for our house debt. I started this to put us on an achievable schedule to pay off the house within 5 years. I’m on payment 30 of 58. It’s exciting for me to see the acceleration in principal reduction – both from larger payments and decreasing interest due.

Posted in

Debt,

Goals

|

3 Comments »

August 5th, 2020 at 12:41 am

Yes, I know it’s August! I’ve had a couple of busy weeks and didn’t get around to this.

My 2020 goal #2 is to adopt a permanent health-enhancing habit each month. My new health habit for July was to disconnect one day a week. For me it’ll usually be a Saturday since I work and I’m often getting prepared for the week ahead on Sundays (unfortunately).

On my disconnected day, I will avoid screens. Computer screens, TV screens, ipad mini, and phone.

NEW HEALTH HABIT #7:

Have one disconnected day each week.

BENEFIT:

• Spending more focused time in my relationships

• More likely to spend time outdoors

• Less stress caused by reading ratings-seeking controversial news stories

• Increased productivity since there aren’t distractions

• Less guilt from wasting time on thoughts and activities that really aren’t important

• More time for reflection

• Become more present and authentic.

COST:

Upfront – zero

Ongoing – zero

There might be a cost savings because I can’t order online! 😉

2020 health habits so far:

(1) Fast one day per month

(2) Consume fresh organic juice at least 3 times a week

(3) Stop storing food in plastic containers

(4) Spend at least half an hour outside every day

(5) Drink 32 oz filtered water every day

(6) Do strength training exercises twice a week

(7) Disconnect one day each week.

I remember that CJ once did something similar to this one year for a resolution.

Posted in

Health,

Goals

|

2 Comments »

July 1st, 2020 at 09:37 pm

Another quarter has passed so it’s time for my annual goals check-in to keep my goals visible and prompt me to correct course where needed.

(1) Get EF back to 3 months’ basic expenses – DONE! Poodle jumps!

(2) Adopt a permanent health-enhancing habit each month – on target

(3) Renew my professional certification by the September due date – DONE!

(4) Pay no CC interest or fees – on target

(5) Spend time with each kid to encourage his current area of growth – on target

(6) Complete identified home maintenance - behind

(5) Areas of focus:

DS1 – career planning – restart due to Covid-19

DS2 – housing of his own - DONE

DS3 – college transition – in progress & challenging

DS4 – Scout rank advancement – in progress & challenging

DS5 – Confidence, schoolwork – good progress made, will continue in Fall

(6) Next maintenance:

Replace half-bath light/fan – no progress this quarter

Pressure-wash house - DONE

Painting: living room – DONE, family room – no progress, & downstairs ceilings – no progress

Overall, I’m pleased but it’s clear where I need to put some focus. Two of the three remaining home maintenance tasks are to be hired out and one I can do myself. For that one, all I need to do is buy a matching can of paint and get off my duff.

My health habits are going fine, but I still find fasting and water consumption unnatural. In order to stay on course, I really have to think about it and make myself do them.

My professional certification is good for three years so it won’t expire until Sept 2023. I don’t think I’ll be renewing it again.

Posted in

Goals

|

2 Comments »

June 30th, 2020 at 01:45 pm

A few years ago, I read a financial article, book, or blog (I can’t remember unfortunately.) that had an impact on how I prepare for retirement.

Before then I had just focused on a number to achieve for my retirement account – one that would support a ‘retirement phase’ budget with a 4% annual withdrawal. My thought, like many others, was that my retirement date would be the day I achieved that number. I could project that date but not count on it. The article made me rethink the approach and instead think more about my remaining time and its value. So, make the DATE the goal, not the AMOUNT. After reading, I decided to set a deadline for my retirement start date and then work to make that happen. There’s a mental shift, at least for me, in having a “deadline” instead of a “target date”. A target is something that I work toward and hope it works out, but know it might not and that’s okay. A deadline on the other hand is something I work toward with some sense of urgency because if it doesn’t work out, I have to resort to a back-up plan that isn’t as nice. When I have a deadline, I tend to make sacrifices earlier if necessary so I won’t miss it.

June 30, 2025 is my retirement start deadline. I will be retired on that day. It makes me excited just to type that! That makes today a milestone – my retirement is a maximum of 5 years from today. What if I don’t have the magic number in the retirement account? Then I will adjust my retirement lifestyle, but I will not change the date. One thing that has reinforced my view has been this site, where I see several of you in retirement living quite well without a huge nest egg. There are so many accounts too of people who had a sudden disability that resulted in that date being selected for them and they weren’t prepared. And others who achieved their magic number but have the ‘one more year’ syndrome for several years because they worry about the potential flaws in their calculations. I also encountered one of those Monte Carlo simulators that included the probability of being dead along with the probabilities of being broke or wealthy. That drove home the concept to me: I want to control how I spend the rest of my life.

2025 is the year I turn sixty. I can access my retirement account without penalty then. I won’t qualify for Medicare yet. My youngest boys won’t be finished with college. All those factors are included in my planning.

I set a list of prerequisites that must be met if I voluntarily opt to retire before June 30, 2025. In order to allow myself to retire earlier, I have to have these things accomplished:

(1) Retirement account on target for 7 figures on 60th birthday

(2) College savings on target for full funding

(3) Mortgage paid off

(4) Savings of basic expenses until 60th birthday set aside

(5) No consumer debt

I track my progress against those prerequisites each quarter. I have a timeanddate.com countdown set too – today I have 260 more Mondays until my deadline.

Posted in

Debt,

Retirement,

Goals

|

6 Comments »

June 28th, 2020 at 01:47 pm

My 2020 goal #2 is to adopt a permanent health-enhancing habit each month. My new health habit for June is to have two resistance training workouts each week.

I have a book that illustrates a few no-equipment-needed strength-building moves for different body parts. I have a health club membership too where I can use machines. This is an area of weakness for me. (I feel like I’ve said that about several of my health habits!) DH is disciplined with workouts but not with diet. I tend to be the opposite. If we could combine ourselves, we’d be the ideal, or the worst…!

The reason I chose strength training is that as I get older it seems like my muscle tone is deteriorating before my eyes. And I want to maintain my strength so I can remain active as I move into my retirement phase of life. So, it’s for both aesthetic and quality of life reasons.

NEW HEALTH HABIT #6:

Do strength training exercises twice a week.

BENEFIT:

Strength training can do all this & more:

• maintain lean muscle mass

• preserve bone density, reducing the risk of osteoporosis for women

• raise metabolism (once muscle mass is improved)

• reduce risk of injury

• improve balance

• improve the muscle’s ability to use glucose, decreasing blood sugar levels

• reduce cancer risk by lowering visceral fat

• increase mental resiliency (anti-anxiety effect)

• improve flexibility & mobility

COST:

Upfront – zero

Ongoing – $20/month health club membership

2020 health habits so far:

(1) Fast one day per month

(2) Consume fresh organic juice at least 3 times a week

(3) Stop storing food in plastic containers

(4) Spend at least half an hour outside every day

(5) Drink 32 oz filtered water every day

(6) Do strength training exercises twice a week

Posted in

Health,

Goals

|

5 Comments »

June 27th, 2020 at 01:09 am

Today was a milestone day for DS2. He’s moving into his own place. He graduated in May and then started working in a town about a 45-minute drive away. He was unable to get an apartment for months mostly because of Covid-related shutdowns. Property management companies weren’t even showing places. He also had decided only to consider apartments that were biking distance to his work and reasonably priced.

Finally, he found a place that suits him. It’s a two-building complex where each building is a 4-plex and it’s in the town where he works. It’s not pretty-looking on Google maps, but it’s practical for him. There’s even a laundromat across the street. He said he could walk to work in about 15 minutes. It’s basic – a one-bedroom apartment with a bath and a combined living room and kitchen area. He’s living alone though and wanted to live cheaply so he can save money for the next couple of years. I think he’ll be paying about $600/month in rent. In preparation for the move he bought a router for his internet, arranged for utility accounts in his name, bought a window A/C unit, and rented a U-Haul to move all his belongings. I’m surprised that he was allowed to rent the U-Haul since he isn’t 25 yet but he didn’t ask for help so I guess it was okay. Maybe the rental companies are being more lenient since their business is slow these days. But all those things are adult activities and I could tell that DS2 is feeling proud that he’s independent. I’m proud too.

Before he drove away in the big van loaded with his things, he told me that we could go see his place in a week. I think he wants time to get his place sorted before he shows it off to us.

DS4 helping DS2 load the moving van

I guess my next move is to have DS2 removed from our auto insurance. Hopefully that will save a few bucks because having DS3 on the policy is costing us plenty.

Posted in

Goals,

Kids

|

6 Comments »

June 23rd, 2020 at 01:31 am

I have met my first goal for 2020: Get EF back to 3 months’ basic expenses. It feels nice especially in the current economic environment. For us three months of expenses is $10,500 and the EF bumped to $10,700 with my recent regular monthly contribution. It was close last month but I didn’t feel comfortable taking funds from something else and throwing it in.

I’ll be evaluating my progress on all annual goals at the end of the quarter which is in just a couple of weeks.

I may set a goal in 2021 to get the EF to 6 months of expenses.

Posted in

Saving Money,

Goals

|

3 Comments »

June 1st, 2020 at 12:01 am

I’ve been on a slight hiatus due to feeling overwhelmed and discontinuing unnecessary tasks as a result. And it wasn’t directly because of the country’s 3-month turmoil either but instead my fretting about family members I love. In two separate situations (DS3 and my dad), I watched consequences from poor choices while I was powerless to do anything. But pray, which I did. Both situations eventually resolved themselves better than I thought possible but boy – I feel like I lost a year off my life from the stress. I really wish I knew a secret to truly let go of situations out of my control when they’re close to me.

The good news is that I have been keeping up with the high priority items directly in my control. So back to regularly scheduled programming…

My 2020 goal #2 is to adopt a permanent health-enhancing habit each month. My new health habit for May is to drink 32 oz of filtered water each day. (in addition to any other liquids I consume)

I think the ideal water intake for an adult is more than this but it’ll be a step up for me. I have a good quality water bottle that I keep at my desk. Two fill-ups should be at least 32 ounces.

NEW HEALTH HABIT #5:

Drink 32 oz of filtered water every day.

BENEFIT:

Drinking water positively impacts brain function, energy levels, digestion, and metabolic rate. Water intake eliminates headaches caused by dehydration and can prevent kidney stones. It aids in detoxification and lubricates joints, eyes, and skin.

COST:

Upfront – zero (I already have a filter.)

Ongoing – zero

2020 health habits so far:

(1) Fast one day per month

(2) Consume fresh organic juice at least 3 times a week

(3) Stop storing food in plastic containers

(4) Spend at least half an hour outside every day

(5) Drink 32 oz filtered water every day

Posted in

Health,

Goals

|

2 Comments »

April 21st, 2020 at 06:59 pm

My 2020 goal #2 is to adopt a permanent health-enhancing habit each month. I’ve decided that my new health habit for April will be to spend at least half an hour outside every day.

It’s a shame that I have to work to make this a habit but I do. Even working from home, some days I realize that I didn’t get out at all except to pick up the mail. Especially when the weather is cold. So now unless there’s a bad storm or the temperature is in the single digits, I’m going to spend time outside. It doesn’t have to be for exercise – I could just drink my coffee on the deck. Part of it is covered so I could do that on a rainy day too.

NEW HEALTH HABIT #4:

Spend at least half an hour outside every day.

BENEFIT:

Provides a de-stressing effect, might improve short-term memory, creativity, and the ability to focus, reduces inflammation, helps eliminate fatigue, may prevent depression, may protect vision, lowers blood pressure, may boost the immune system

COST:

Upfront – zero

Ongoing – zero

Cheap and simple.

2020 health habits so far:

(1) Fast one day per month

(2) Consume fresh organic juice at least 3 times a week

(3) Stop storing food in plastic containers

(4) Spend at least half an hour outside every day

Posted in

Health,

Goals

|

2 Comments »

April 17th, 2020 at 11:09 am

I put the stimulus payment to good use – the balance on the 0% CC expiring in May is history. Woohoo! That means that my annual goal #4 - pay no CC interest or fees – will be achieved so long as I don’t take on additional CC debt this year.

I’ll close the CC in the next few days. I don’t need the credit since I have another card with rewards for everyday purchases. Next focus for unallocated funds is the EF: annual goal #1 - get EF back to 3 months’ basic expenses.

Our dog found two more eggs in the yard yesterday! One just had Skittles but the other had a dollar bill.

Posted in

Debt,

Goals

|

4 Comments »

April 1st, 2020 at 12:56 pm

The first quarter of 2020 has passed so it’s time to check the status for my annual goals and plan my adjustments and/or next steps for this quarter.

(1) Get EF back to 3 months’ basic expenses – on target

For us 3 months of basic expenses would be $10,500. Currently the EF has $5050, which is less than half the goal, but it started the year at $3500 so progress has been made. My focus for unallocated dollars right now is on the soon-to-expire 0% CC. Once that is gone, the EF will be the focus so I still consider it to be on target for the year. The current economic situation illustrates the need for an EF and I wish I were in a better situation with mine. The reason I don’t fret (too much) is that the most likely emergencies that we would have that exceed my EF’s coverage are medical and unemployment situations. For medical, we have an HSA account that would cover costs and for unemployment, I know that my employer has historically been generous with severance pay. Still, I’ll feel more at peace when my goal is achieved.

(2) Adopt a permanent health-enhancing habit each month – on target

Oh yeah – I’m proud of this one. I have started 3 habits and kept them up. I can’t say that I enjoy fasting – it’s hard for me – but one day a month is doable. And in fact it’s really 24 hours so I only miss two major meals. Usually I start the time around 6:30p after an early supper. The current pandemic also illustrates the importance of a healthy immune system so I’m thankful that I made this an area of focus. I feel motivated to continue with my monthly habit additions.

(3) Renew my professional certification by the September due date – on target, maybe even ahead

Renewing my certification involves paying a fee which is not too onerous and earning continuing education units which is a lot of effort. I started the year being 38 units short of being able to renew. I’ve since earned 18 units so I currently have 20 units to go. If I can keep up the current pace I’ll finish in the summer.

(4) Pay no CC interest or fees – on target

In order to meet this goal, I had to deal with a CC balance on a 0% card (and continue to pay off our normal expenditures each month of course). I’ve written another post about my split strategy to move some of the balance to a new 0% CC and to pay the rest off. I currently have around $1900 remaining on the CC that must be paid by mid-May. My projections show that this should be completed in time. Then I’ll cancel that CC.

(5) Spend time with each kid to encourage his current area of growth – okay, but could be better

All-in-all I did fine on this. I helped DS1 create a budget and provided support for his job hunt which was successful though he hasn’t started the new one yet and there may be uncertainty now. DS2’s focus has become more about keeping up since his last semester of college is online now. I didn’t spend the time I’d planned helping him find housing. However, now that he’s closer to the job location since campus is closed (It’s 2+ hours away.) it’ll be easier when he does have availability. Good progress on DS3 as I reported earlier. He’s committed to a college and found a roommate. Now to see how he finishes high school with the school doing a nontraditional online format, possibly for the rest of the school year… I have worked with DS4 on his rank advancement but not enough. He’s so close to achieving the next rank of Star. And ironically working with DS5 has been easier with school off and then online. I’ve just got to keep it up.

(6) Complete identified home maintenance – behind

It’s always been my experience that I can’t have everything going well at the same time. What I have done is to get a quote for the pressure washing. I allocated funds for it so now I just need to schedule it. I requested a quote for the fan/light replacement some time back but the electrician never got back with me. Maybe the job is too small to be worth his effort. I need to look for another company. Most of the painting I’m doing myself (not the ceilings – I’ll hire that out). I moved furniture away from one wall in the living room to prepare to paint several weeks ago and it’s still like that! Maybe this weekend.

Overall, I’m happy with the quarter’s progress.

Posted in

Goals

|

0 Comments »

March 14th, 2020 at 04:03 pm

My 2020 goal #2 is to adopt a permanent health-enhancing habit each month. I’ve decided that my new health habit for March will be to stop storing food in plastic containers. I’m going to use glass containers instead.

I don’t think it’s unhealthy for food to just touch plastic but I’ve read that temperature fluctuations can cause plastic to leach into the food. I stopped microwaving with plastic containers years ago but the rest of the family will do it if it’s most convenient. My dad personally knew a woman who was taken to the hospital (I forgot the symptoms.) and the cause was her consumption of bottled water that had gotten very hot in the trunk of her car then cooled back down before she drank it.

NEW HEALTH HABIT #3:

Stop storing food in plastic containers.

BENEFIT:

Prevents consumption of plastic (microplastic) that is toxic to the body

COST:

Upfront – $95

Ongoing – zero

The upfront cost is the total for the purchases I made of glass replacements for my plastic containers. I bought a set of Pyrex containers with color-coded plastic lids for leftovers, six canisters for storing rice, pasta, & legumes, and two glass carafes with plastic lids to replace our yucky stained plastic pitcher.

This new habit is easy compared to the others.

2020 health habits so far:

(1) Fast one day per month

(2) Consume fresh organic juice at least 3 times a week

(3) Stop storing food in plastic containers

Posted in

Health,

Goals

|

2 Comments »

February 27th, 2020 at 03:42 pm

I think I will be able to continue my new juicing habit without needing to increase the grocery budget. This is good news because I predicted that the budget would increase by $50/month. That increase would be realistic if I weren’t flexible about the veggies used. But I have discovered that Sam’s typically has 5-pound bags of organic carrots for only $3.50 and that carrots are a good base for most juices. My juice is usually mostly carrots with apples, celery, and/or raw ginger. Cucumbers are good with apples, but organic ones have been especially expensive. Perhaps in the summer when they’re in season the organic ones will be cheaper.

I’m not having any problem getting in 3 glasses each week – I usually have more. And while I’m at it I make extra and offer a ‘shot of health’ to another member of the family. I’ve gotten used to cleaning the new juicer too. It’s still not fun, but it’s not hard to do.

Posted in

Health,

Goals

|

2 Comments »

February 20th, 2020 at 03:37 pm

My 2020 goal #4 is “Pay no CC interest or fees”.

Since I have a balance on a 0% card that expires in May, I’ve decided to do a combination of paying it off and transferring to another 0% card with no fee involved. I applied for a Bank of America card (I mentioned it on Amber’s blog earlier.) that has a 0% rate with no fees for balance transfers before mid-March. It was approved and they just completed the balance transfer.

The original total amount parked on the 0% CC was $19k. I transferred $10 of that, leaving me to pay $9 right away. I used the federal refund toward the balance; I will use the smaller state refund toward it; I used a portion of my quarterly bonus; Now I am diverting amounts from regular pay between now and May. I should get ‘er done.

I will likely just pay the minimums to BoA each month while I focus on other goals. My next focus is the EF. Then later in the year I’ll make a plan for what’s remaining on the BoA card. Its 0% special expires in April 2021.

Posted in

Debt,

Goals

|

4 Comments »

February 18th, 2020 at 10:18 pm

I can see that our federal tax refund is expected to be direct-deposited in two days. We’re getting $2606 back this year which means I had too much withheld, but next year we’ll lose $3500 in child/dependent tax credits so I’ll need to adjust withholding to prevent owing a thousand bucks, assuming all other things are equal this year. I’ll take a closer look at that during the summer after I know whether there is any increase in income and after I take some time to research any tax code changes that could impact us.

Of course the $2606 is allocated. I budgeted $900 for our annual CSA membership and the rest to the 0% CC. I over-budgeted slightly for the CSA and I also got a discount for paying it early and in full instead of using a payment plan. It was $815. That’s a ‘full share’ size box of organic veggies every week from April 22nd week to the week before Christmas.

The local delivery site is easily walkable from my house so on veggie day I block an hour in my work schedule to leave my desk and go pick them up. I like having the commitment because it insures that I get exercise and fresh air that day. I bought a used stroller at a garage sale last year just for this purpose because the bag of veggies gets heavy in the middle of the summer.

Now that I have the juicer, I may try juicing some things this year. And by the way, I’m loving the juicer! My favorite so far is carrot-apple with a little raw ginger.

Posted in

Budgeting,

Personal Finance,

Health,

Goals

|

1 Comments »

February 7th, 2020 at 01:53 pm

My 2020 goal #2 is to adopt a permanent health-enhancing habit each month. I’ve decided that my new health habit for February will be to consume fresh organic juice at least 3 times each week.

We used to have a Jack Lalanne juicer but it bit the dust a few years ago. I’ve just purchased a juicer that’s a step up and recommended by some of the health gurus that I follow – the Champion juicer. It’s pricey so it’s only going to be a smart purchase if I really do make frequent use of it.

NEW HEALTH HABIT #2:

Consume fresh organic juice at least 3 times a week

BENEFIT:

Easily boosts absorption of vitamins, minerals, & antioxidants to provide energy and detoxification. Hydrates the body, improves digestion, keeps body in an alkaline state, promotes longevity.

COST:

Upfront – $350

Ongoing – $50/month

The ongoing cost is a guess. I already buy organic fruits & veggies but I do recall being surprised before at how much produce it takes to make a glass of juice. But on the other hand the juice will be a replacement for calories I’m currently getting elsewhere. I’ll update this number once I see the actual change in our grocery bill.

This new habit is an expensive one, probably the most expensive one I’ll acquire this year because it has both an upfront cost and an ongoing cost that are substantial. I was going to wait until later in the year to pull the trigger on this one since I have financial goals too, but I want the health benefits now. Expensive, but still cheaper than medical bills!

2020 health habits so far:

(1) Fast one day per month

(2) Consume fresh organic juice at least 3 times a week

Posted in

Health,

Goals

|

4 Comments »

February 6th, 2020 at 06:15 pm

Mostly out of fear for our upcoming college expenses over the next half dozen years, I made a plan over a year ago to get our house debt paid. Our house debt is a combination of a mortgage and a HELOC. The mortgage interest rate is 3.49%. The HELOC rate, which can change, is 5.64%. So every extra principal payment I make goes to the HELOC.

In order to make it doable when I started, and also to use a method where one bad month couldn’t blow it for me, I created a schedule with defined percentages instead of dollar amounts. The percentages increase over the course of time as I should be able to find additional money to throw at the debt. As you can see (I have to get the photos to work for this post!), I need to come up with $1779 worth of principal payments this month including my regular scheduled payment. That shouldn’t be a problem. But next month, I have another percentage increase.

Only people on sites like this would understand these games that motivate me to do the right thing!

Posted in

Debt,

Goals

|

2 Comments »

February 1st, 2020 at 06:38 pm

For our family January ended on a sad note: FIL died yesterday. He was in hospice so it wasn’t unexpected but still tough to accept.

Yesterday was my fast day too (new habit – one of my 2020 goals) and I survived. Going for two days to get my February day in too was not an option though – 24 hours was as much as I could take. So I’ll plan for another day in February. And I’ve got to decide what my second new health-enhancing habit will be beginning this month.

On the financial front (since that’s the focus of the blog!), DS4 had an interview today for a summer job. He feels good about it. He was nervous but prepared. I’m really proud of him, no matter what happens. Hopefully he’ll get an offer after they check his references.

I’ve stopped using the Ally CC and I’ll redeem my points for cash to the online savings account once my last purchase moves from ‘pending’ – a nearly $300 vet bill for our feline’s annual check-up. Then I’ll be done with that account.

I’ve started doing taxes and hope to finish them within a few days. And I’ve sent principal payments to the 0% CC with a balance and to house debt. I’ve also just been reimbursed for my business trip earlier in the month so I need to send that to the CC before it’s due.

Posted in

Debt,

Health,

Goals,

Kids

|

11 Comments »

January 7th, 2020 at 11:07 pm

I don’t know why but I didn’t feel as eager as I usually do to draft my goals this year. But I know how powerful it is to have them so I am doing it now.

(1) Get EF back to 3 months’ basic expenses

(2) Adopt a permanent health-enhancing habit each month

(3) Renew my professional certification by the September due date

(4) Pay no CC interest or fees

(5) Spend time with each kid to encourage his current area of growth

(6) Complete identified home maintenance

It will be a big year for us – two graduations! (fingers crossed)

Notes:

(4) sounds easy, but I have a balance on a 0% card that expires this year. So it’ll need to be paid off and/or transferred to another 0% card with no fee involved

(5) Areas of focus:

DS1 – career planning

DS2 – housing of his own

DS3 – college transition

DS4 – Scout rank advancement

DS5 – Confidence, schoolwork

(6) Next maintenance:

Replace half-bath light/fan

Pressure-wash house

Painting: living room, family room, & downstairs ceilings

Posted in

Goals

|

5 Comments »

January 5th, 2020 at 10:34 pm

I figure that it’s probably good to give an overview of our family situation and my values so you can understand why I spend on the things I do. And also hold me accountable when my spending patterns do not appear to support my stated priorities.

DH and I married young but didn’t have kids until later. For most of our marriage I have been the primary breadwinner, and since 2007 when he suffered brain damage from a bicycle accident, I have been the only breadwinner. It’s been interesting to read MM’s blog because her situation has some similarities. We have 5 boys ranging in age from 16 to almost-25.

I plan to retire the year I turn 60. Much of my financial strategizing is done with that in mind, but there are things that I will spend on even when it takes me further from that overall goal:

++ Family, especially preparing the boys for their adulthood

++ Health, mostly preventive things that are not medical services

++ Home environment, because it has such an impact on my mood and outlook

I’m probably forgetting something, but those are the biggees.

Posted in

Goals

|

2 Comments »

|