|

|

|

November 12th, 2021 at 02:40 pm

I have completed my Christmas shopping – even stocking stuffers. Never in my life have I accomplished this before Thanksgiving. The news of supply chain issues and potential shortages gave me a sense of urgency I guess. But it feels good to be able to enjoy the time now.

We will still have expenses for a tree and our traditional Christmas Day seafood gumbo ingredients. Maybe we’ll get a couple of gingerbread house kits this year too. The boys used to decorate them and then we would gift the best-looking ones to select neighbors.

Posted in

Budgeting

|

3 Comments »

November 10th, 2021 at 03:36 pm

As mentioned in a previous post (2020) I have a deadline set for the start of my retirement. And I have a list of prerequisites to determine whether I’m in a safe-enough-for-me position to retire sooner. Each quarter I evaluate my progress against those prerequisites, and my quarterly check-in for this is aligned with my birthday instead of the standard calendar quarter. That’s because a couple of my prerequisites are based on my 60th birthday so the calculation is simpler.

Result for this check-in: I’m slowly getting closer! I’m now planning to pull the trigger in 2023 ahead of my original target of 2025.

In order to pull the plug immediately, I’d have to have these things accomplished:

++ Retirement account on target for 7 figures by 60th birthday

++ College savings on target for full funding

++ Mortgage paid off

++ Savings of basic expenses until 60th birthday set aside

++ No consumer debt

Currently my progress is:

++ 100+%

++ 57.5%

++ 76.5%

++ 14.7%

++ 100%

Assumptions for these calculations: average annual return on investments will be 5%, no further contributions to investments, full funding = 40 semesters (8 x 5 boys), $36,000k annually for basic expenses, starting consumer debt was $10k.

College for the twins may be cheaper because they both are planning to start at the local community college but I’m keeping assumptions the same so I’m comparing apples to apples each quarter.

Posted in

Uncategorized

|

1 Comments »

November 9th, 2021 at 06:51 pm

We traveled south last month to celebrate my Dad’s milestone birthday with him. It was special because a year ago we hoped and prayed but didn’t expect that he’d live to see this one. My brothers and I hosted a surprise party at a nice restaurant and it was indeed a surprise. Everything turned out perfectly. My share was about $450. Worth. Every. Penny.

The boys still attended school each weekday morning while we were gone since they’re in cyber school. I had the other half of my amalgam fillings replaced while we were there with the dentist who did the first half. I bought an annual subscription with that dentist to keep the price lower for my dental work. I may need to cancel it within the next few months so it doesn’t auto-renew. I don’t remember if that was a default in their contract. No sense in having a dentist more than a thousand miles away!

I’m so glad we traveled before American Airlines started cancelling flights. That would have been awful. I’m happy to say that our travel was uneventful.

Posted in

Budgeting

|

0 Comments »

November 8th, 2021 at 02:55 pm

I know it’s my age/generation but whenever I hear anything about cryptocurrency, it seems like fake money to me. I don’t get it. And I do realize that our paper money is no longer backed by precious metals so in effect its value is debatable too. I admit that I’m an old fogie in this area.

So recently DS2 installed something on DS5’s computer that earns cryptocurrency. The best I can understand after asking for an explanation is that DS5’s graphics card is being rented out for processing power when he isn’t using it. He’s making the equivalent of $2/day by having his computer run this. That piqued my interest. DS2 has his computer set up with multiple graphics cards connected to a single motherboard and he’s making a few hundred dollars a month while he’s at his real mechanical engineering job. That’s wild to me. He occasionally converts the crypto to dollars and transfers them to his bank account. Apparently the only gotcha is that you have to have a quality graphics card and they’re hard to come by now because lots of people are doing this. I assume that all that processing uses some electricity too.

I just find it interesting that young adults have discovered an automated income stream. Kids today!

Life of leisure Life of leisure

Posted in

Personal Finance,

Kids

|

4 Comments »

November 7th, 2021 at 12:02 am

We’re in the open enrollment period for benefits at work. I was happy to see that my share of the health insurance premiums will not increase in 2022. Both the 401k maximum contribution and the HSA maximum contribution will increase by $1000 so that’ll be about $170/month in additional deductions. I get paid twice each month so it won’t be too noticeable.

DS1 is no longer on my insurance since he turned 26 in 2021. It was a little sad seeing “coverage terminated” by his name but of course it’s a good thing – he’s completely on his own. DS2 is on his own as well but still on the insurance to save money. It doesn’t cost me any more to keep him on and his employer would require that he pay a premium for their insurance. He’ll be able to do that for a couple more years.

In other financial news, DS4 & DS5 turned 18 recently so I no longer pay allowance – to anyone. Woohoo! That’s like a raise. With my progressive rate allowance system, they were each costing me $34/week.

Posted in

Budgeting

|

3 Comments »

October 8th, 2021 at 03:31 pm

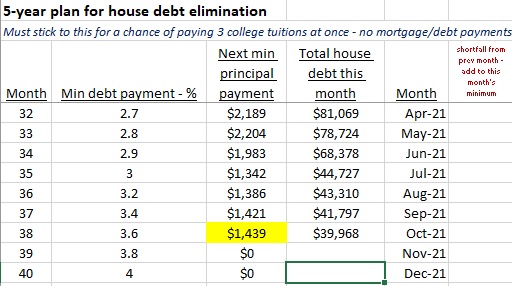

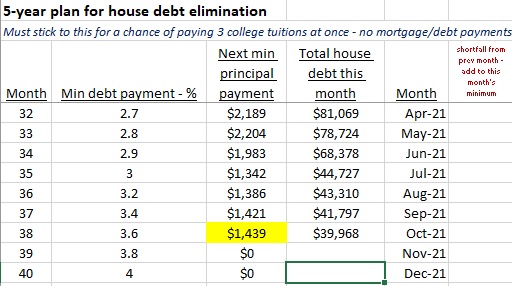

A minor milestone - the house debt is now below $40k.

If I stick to my plan it’ll be paid off in June 2023. I’m seriously considering selling some company stock in 2022 to just be done with it. It’s a focus for me because it’s our only debt. The credit card debt is there but it’s paid in full when it’s due.

Posted in

Debt,

Goals

|

3 Comments »

September 6th, 2021 at 04:17 pm

A recent post in an online neighborhood app touched me and as a result we have three more felines. Making a total of five plus a dog. It’s not a frugal move!

The woman who needed to rehome them is terminally ill and nearing the end. She doesn’t have a husband, children, or siblings. It’s very sad for her – having to let go of her pets but knowing that it needs to be done. It’s traumatic for the cats too – I’m being very patient with them as they get accustomed to their new home. So far they are living in the master suite only.

DH says that I’m now an official crazy cat lady. I’m okay with that.

Posted in

Personal Finance

|

8 Comments »

August 7th, 2021 at 12:43 am

I mentioned in a previous post (2020) that I have a deadline set for the start of my retirement. And that I have a list of prerequisites to determine whether I’m in a safe-enough-for-me position to retire sooner. Each quarter I evaluate my progress against those prerequisites, and my quarterly check-in for this is aligned with my birthday instead of the standard calendar quarter. That’s because a couple of my prerequisites are based on my 60th birthday so the calculation is simpler.

Result for this check-in: I’m getting closer! I’m hoping to pull the trigger in a couple of years.

Currently my progress is:

Retirement account on target for 7 figures on 60th birthday: 100+%

College savings on target for full funding: 55%

Mortgage paid off: 73%

Savings of basic expenses until 60th birthday set aside: 14.4%

No consumer debt: 100%

Assumptions for these calculations: average annual return on investments will be 5%, no further contributions to investments, full funding = 40 semesters (8 x 5 boys), $36,000k annually for basic expenses, starting consumer debt was $10k.

The next time I check-in on this progress will be around my birthday.

Wow - I really struggled to get the formatting for this post to include all the content and not look wonky...

Posted in

Retirement,

Goals

|

1 Comments »

August 3rd, 2021 at 10:41 pm

Businesses in our area have been struggling to maintain staffing. I assume that it’s related to the stimulus package(s). Some have restricted their business hours or their offerings in response to the shortage. Some of the fast food restaurants just close for the day when enough workers don’t show up. It’s sad. But – it’s been a help to teenagers that are off for the summer and want to make some money, including ours.

DS4 kept his lifeguard job and got a pay increase this year. DS3 got a surprisingly high-paying job at an Amazon warehouse. DS5 got his first ever job at Burger King. It’s been a great learning experience for him. He’s learned about using cash registers, customer service, and of course making (unhealthy) food. The boys were required to take a career education class earlier in high school and one assignment was drafting a resume. Poor DS5 had no job experience, no volunteer work – pretty much a blank page with LARGE font to make up for the lack of content. It was a wake-up call. Now’s he’s done a cool volunteer project offered at school and gotten his first job.

Posted in

Education,

Kids

|

3 Comments »

August 3rd, 2021 at 01:14 am

I’ve been back home since the middle of April and just haven’t gotten back in the habit of blogging. There was quite a bit to do to get the house back in order and my office set up. And catch up to do with neighbors and friends after being away for months. During the time I was gone, two people that were part of my regular routine died – not friends exactly, but folks I chatted with regularly in the neighborhood and the grocery store. That discovery put a damper on last week.

At work it’s like I never left. Finances are trucking along. The company stock has been a huge help with that.

This post is to push me back into the habit. I’ll blog on particular topics in the upcoming days. I need to organize my thoughts.

Boy Scout camp Boy Scout camp

Posted in

Personal Finance

|

2 Comments »

March 30th, 2021 at 07:09 pm

Tomorrow we move back to Dad’s house and a week and a half later, we head home. Then I return to work. Change will be the norm for the next couple of weeks.

Our annual egg hunt will include only two of the five boys but the addition of three cousins this year, and it’ll be at Dad’s house. I mailed each of the three boys at home a consolation prize. I paid just as much for the shipping as the value of the contents. It was a case where the sentimental value made the shipping cost worth it. (around $20 each)

Half my amalgam fillings are replaced now and the other half scheduled for the Fall. I met with the dentist here this morning to review sleep study results and to do an entire head scan. The information that can be gleaned from the tests about my breathing and potential health conditions is surprising to me. I found it interesting.

I spent over $100 buying books and CDs related to the boys' classes and calculators with trig functions since they left theirs at home. 'Educational' budget line item.

Posted in

Education,

Health,

Kids

|

1 Comments »

March 23rd, 2021 at 03:12 pm

I hadn’t had my teeth cleaned in more than a year thanks to Covid so I decided to make a dentist appointment here instead of waiting to return home. In line with my intentions to move to holistic healthcare providers, I searched for a holistic dentist here. Since it’s a large city there are many more options here than at home.

Last week I went to my appointment and there I made the decision to have my old fillings with mercury replaced with a healthier alternative. This dental practice has all the expertise and equipment to do it safely. Half my mouth will be done this week and the other half in 6 months or so. I’ll coordinate that dental visit with a trip to see Dad, maybe for his birthday this Fall. It’s not going to be cheap but I’ve been contemplating this health improvement for a few years. The cost will be slightly more than $1000 per side so $2000 total.

I was impressed with the dental office. They have their own clean water system and clean air system and everything is high-tech and online. Such a contrast to my dentist at home who I like a lot BTW. It’s time though to make a move – I think he’ll be retiring soon. So next on my action list is to find a holistic dentist nearish to home.

Posted in

Health

|

2 Comments »

March 22nd, 2021 at 06:08 pm

I redeem credit card points for gift cards as soon as I’ve earned enough to qualify for one. This month I chose a Lowe’s gift card for the $50 reward. I’m sure we’ll use it this spring for yard work or a home repair.

Posted in

Personal Finance

|

1 Comments »

March 20th, 2021 at 06:19 pm

As hoped, we received a stimulus payment based on our 2019 AGI since we haven’t filed our 2020 taxes yet. The $2100 is a pleasant surprise and will be used to pay for our annual CSA membership and the travel costs of returning home next month.

Posted in

Budgeting,

Personal Finance

|

1 Comments »

March 15th, 2021 at 08:02 pm

The closing for the SC land sale occurred at the end of last week. UPS delivered a check with my proceeds this morning and within an hour I deposited it into my account with mobile banking and paid the 0% interest credit card in full online. Done!! Now we only have house debt.

Posted in

Debt,

Goals

|

1 Comments »

March 12th, 2021 at 02:24 pm

I started replacing some things before they failed several years ago. Like water heaters and car batteries. The kind of things that will certainly fail at a time that’s inconvenient and possibly risky. It may be a little more expensive to replace an item prematurely but that beats being inconvenienced when it eventually fails.

The newest (2010) car’s battery just got us though. We bought it used about a year and a half ago so I didn’t know how old the battery was. Because we weren’t sure it was the battery, it was taken to the shop. Now we’ll pay for a new battery and labor. Not next time though. I will place a tickler on the online family calendar to replace this battery at the end of its warranty.

Battery cost with labor: $198

Posted in

Personal Finance

|

0 Comments »

March 10th, 2021 at 02:20 pm

One day this past week was ‘Colleague Appreciation Day’. I’m not sure if that’s a thing or if it’s just something that’s created and celebrated at my company. We each received an e-mail with an electronic coupon for a free Starbucks drink. How nice that it’s everywhere – I got a free fancy coffee at a Starbuck’s with a drive-thru between the hospital and our temporary home.

We've gotten to know one of the neighbors We've gotten to know one of the neighbors

Posted in

Personal Finance

|

2 Comments »

March 9th, 2021 at 03:26 am

I’ve probably mentioned before that we received stimulus payments during 2020 because they were based on 2019 income. We lucked out because 2019 is the last year the twins qualified for the child tax credit and that positively impacted the payment we received. Our adjusted gross income is within the phase-out range but even the reduced amount was a pleasant surprise.

I’ve held off on filing our 2020 tax forms because we’re going to owe money this year as a result of the unexpected stock bonus just before the company went public last year. It could be that my delay will work in our favor and result in another reduced stimulus payment. I’ve read that the phase-out range is smaller and steeper so even if we qualify, it may be next to nothing. But again, anything would be a pleasant surprise.

Posted in

Personal Finance

|

1 Comments »

March 7th, 2021 at 12:12 am

A funny thing happened. Somehow my dad received an issue of Cosmopolitan in the mail. We joked about it but I did read it before it went to the trash. And guess what? I learned a financial fact. According to the article inside, the last coronavirus relief legislation (CARES Act) increased the list of allowable expenses for HSAs and FSAs. Now in addition to medical co-pays and medications, items like menstrual products, over-the-counter meds, and sunscreen are now qualified expenses for reimbursement. And Amazon even has a filter for them: www.amazon.com/hsa That’s useful information!

Posted in

Personal Finance,

Health

|

1 Comments »

March 5th, 2021 at 01:32 pm

In 2009 when my Grandma died, she owned a piece of land that she’d inherited from a childless sibling. We didn’t realize that she had it because she’d never mentioned it or used it. The South Carolina land is bounded by train tracks on one side and has huge power lines running over it. My brothers and I inherited the land and decided to keep it. We paid the property taxes each year but we haven’t done anything with it either. After a brief conversation with them two weeks ago, my brother put an ad on Facebook Marketplace. Within a few hours, we had offers! It turns out that the little town is growing and despite features that I would consider undesirable, the 3-acre lot was attractive to several businessmen.

We accepted an offer and have just completed paperwork to have the closing done without us in attendance. My third of the proceeds will be about $8000. Unexpected money is always nice and I know exactly what I will do with it. I will pay off the 0% interest credit card that expires next month where I have $7400 of debt parked. I feel fortunate that it’s just enough to pay it completely without touching savings and that I don’t need to look for any more 0% CC offers.

Posted in

Debt,

Personal Finance

|

0 Comments »

March 4th, 2021 at 02:44 pm

I calculate our net worth each month on the 3rd after the house debt payments have cleared. It’s up $32k from last month. The increase is due mostly to the market rather than anything new or different – savings and investment contributions are automated. Our house value is up too according to Zillow.

The weather is getting warmer here so we've begun getting outside to exercise. I want to make sure I'm consistent with walking to support my bone density.

Posted in

Personal Finance,

Health

|

2 Comments »

March 3rd, 2021 at 08:50 pm

Even though I’m living away from home, I followed up on some medical tests – bloodwork, an ultrasound, and a baseline bone density scan. I am thankful that my doctor suggested the bone density scan because it showed that I already have osteoporosis in my spine. Yikes! I’m researching osteoporosis now.

Our family deductible was already met so the out-of-pocket costs for those things was insignificant, about $30. What surprised me though was the price of the bone density scan. It was about $100. Given my results and the fact that it’s a quick and painless procedure, I may choose to have them annually even if insurance doesn’t cover them that often.

On the other side of the fence, Dad’s hospital bill – just the hospital bill – for his organ transplant is $289k. With the associated bills for the professionals involved, it’ll be at least $350k. He’s doubly insured so his cost should be a tiny fraction of that.

Posted in

Personal Finance,

Health

|

2 Comments »

March 2nd, 2021 at 03:24 pm

DS3 went back to college for the spring semester. The dorms are open though the classes are online. Students have the option of attending from home but he’s an athlete and so far, spring sports are on. The semester will be split up into mini-phases like they did in the Fall so that if a course returns to the classroom, the classes will be small. It’s interesting to see the creative responses to the Covid-related constraints in place now.

The semester bill including food and housing but not books and materials was $10,400. This is how the funding was cobbled together this time:

$1000 – scholarship

$4000 – cash set aside

$5400 – 529 savings

DS3 is looking into other scholarships since he knows we’d split them with him. No word yet on any successful results.

Posted in

Education,

Kids

|

0 Comments »

February 12th, 2021 at 02:35 pm

I have a deadline set for the start of my retirement and I have a list of prerequisites to determine whether I’m in a safe-enough-for-me position to retire sooner. Each quarter I evaluate my progress against those prerequisites, and my quarterly check-in for this is aligned with my birthday instead of the standard calendar quarter. That’s because a couple of my prerequisites are based on my 60th birthday so the calculation is simpler.

Result for this check-in: Again, it's not time to retire now, but I’m continuing to make good progress.

In order to pull the plug immediately, I’d have to have these things accomplished:

Retirement account on target for 7 figures on 60th birthday

College savings on target for full funding

Mortgage paid off

Savings of basic expenses until 60th birthday set aside

No consumer debt

Currently my progress is:

100+%

54%

48%

8%

25%

Assumptions for these calculations: average annual return on investments will be 5%, no further contributions to investments, full funding = 40 semesters (8 x 5 boys), $36,000k annually for basic expenses, starting consumer debt was $10k. (At one time I had negative progress on this! For the record though, it’s at 0% interest.)

The next time I check-in on this progress will be in May at my half-birthday.

Posted in

Retirement,

Goals

|

2 Comments »

February 11th, 2021 at 08:07 pm

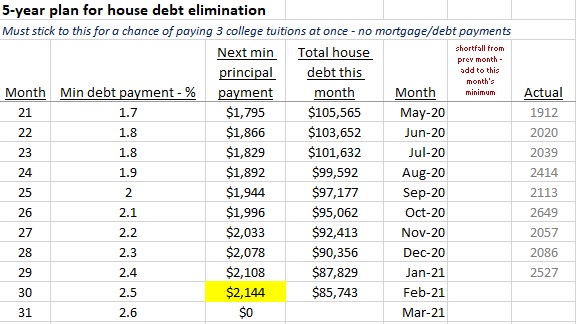

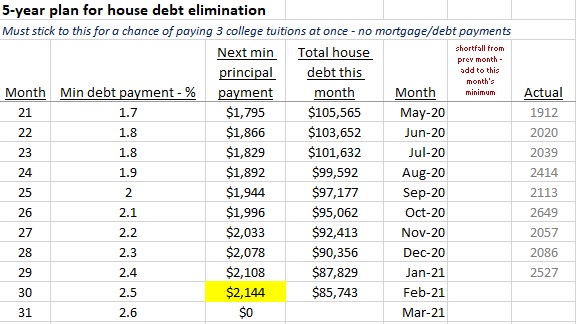

Each month I track the principal payments for our house debt. I started this to put us on an achievable schedule to pay off the house within 5 years. I’m on payment 30 of 58. It’s exciting for me to see the acceleration in principal reduction – both from larger payments and decreasing interest due.

Posted in

Debt,

Goals

|

3 Comments »

February 5th, 2021 at 07:50 pm

In the Fall of 2020 while I was working but mostly focused on Dad, the company launched its IPO. It’s the third attempt so I think that most colleagues didn’t think it’d really happen but this time it went through. The company was profiled on the NASDAQ billboard in Times Square that day with pictures of our colleagues.

How ironic that it was in 2020 – a year in which we took 10% pay cuts because the company expected to perform poorly. Instead, technology companies excelled because of the broad dependence on technology forced by the country’s extended shutdown. Our initial stock price is now double.

I haven’t heard any talk of returning our 10%, but now my stock options are worth much more than before. Many are still unvested so I can’t exercise them yet.

Every colleague also received some shares of stock just before the IPO. I appreciated the unexpected bonus but it threw a wrench into my tax planning. We will owe thousands of dollars in taxes this year partially because the stock gift caused our income to exceed the threshold for the American Opportunity credit. We lost that credit, we lost a dependent (for a good reason – he’s on his own now!), and the twins are too old now for us to get the generous child tax credit. It was good while it lasted. On the positive side, the stimulus payments were based on our 2019 situation so we did get a break in 2020 despite their being 17.

Posted in

Investing,

Personal Finance

|

2 Comments »

January 27th, 2021 at 04:50 am

I did decide to take family medical leave from work. On the first day of leave, as though it was planned, Dad was unexpectedly discharged early.

It’s time off one area but time on another. I’m looking forward to these months. I hope to focus on three areas: Dad’s return to health (of course!), my twins’ schooling, and my health habits. For Dad there are frequent doses of many drugs to administer, things to check, and appointments to attend. It’s a little stressful because I’m afraid of messing something up. The drug choices and doses have been and will continue to be changed frequently over the coming weeks.

Hospital view

While FML is unpaid time, the company does allow accrued sick time to be used. I am very thankful that I have been well over the years so now I can continue to get paid while I focus this time on the family. I’m hoping too that as Dad gets stronger, we can plan small outings to enjoy the city that is our temporary home. It’s a strange time but these will be memories we’ll hold forever.

My finances have done well on autopilot over the past few months. I’ll get back to regular financial posts after month-end. I hope to have more time to keep up with blog posts.

Posted in

Personal Finance,

Health

|

4 Comments »

January 19th, 2021 at 02:09 am

Well, this time it’s been four months since my last entry – unbelievable and yet so much has happened in that time. I’m still down south helping care for my dad but the tide has turned. After months of effort and care, my dad did qualify for the transplant list and finally, finally yesterday morning in the wee hours, the transplant surgery was performed. It was about 8 hours long and successful. He’s in ICU now and likely has another week in the hospital.

The entire process has been an emotional roller coaster but here we are. He has a chance at life. Now we’re required to live in the same city as the transplant center for a couple of months. My brother and I have rented an Airbnb and are prepared to be caretakers for Dad. I’m evaluating taking a FMLA leave from work.

Over the past few months I’ve taken over the administrative aspects of Dad’s life. Now I look forward to transitioning his life back to him. So to add to the list of accomplishments in the previous post:

++ moved Dad’s IRA to Vanguard (and it’s since gained tens of thousands of dollars in value)

++ removed the 30-something rent-free boarder, changed the locks, & installed security cameras

++ organized the bedrooms that had been occupied by the rent-free boarder

++ hired and managed 24/7 caregivers when Dad’s condition reached a level that required constant assistance

This situation has been really hard on my family but I don’t regret my commitment to my Dad. It was life or death – we had to give it all we had. My brother and I were talking about our journey during the surgery and he said something that resonated: “This is what love looks like.”

Posted in

Health

|

8 Comments »

September 12th, 2020 at 10:15 am

It’s been over a month since my last entry and what a month it’s been. I’m currently down south helping care for my dad as he deals with serious health issues. I arrived in time to prepare and then narrowly miss two hurricanes. One of my brothers lives here but Dad’s condition worsened to a point that my brother didn’t know what to do.

The good news is that Dad is somewhat stable now. I monitor his meds and diet and I’m proud to say that I’ve gotten him to enjoy green smoothies. His mental clarity is back but he’s tired and weak all the time. The best-case scenario is that he’ll qualify for a transplant list so his overall condition is still quite serious.

Everything needed attention: his house, his finances, his health, and a couple of relationships. Dad is generous and gullible and he’s been taken advantage of repeatedly. Some things were obvious to us but the more I organize, the more I find out. I am thankful that he’s thinking clearly now so I can ask questions and support by doing things with his approval instead of just taking over.

One of the next tasks on my Dad to-do list is to move his IRA to Vanguard. He has an advisor account with someone he met who is charging thousands of dollars each year in fees. His money is invested in about two dozen funds. It looks needlessly complicated for a modest retirement account. Dad has agreed and he trusts my judgment. Any suggestions for good funds for retirees? (once I get the funds transferred to Vanguard) My own retirement account is more aggressive since I’m not retired and I’m willing to take on some risk. That’s not Dad’s situation.

I’ve made good progress in my time here so far:

++ gotten Dad to retire. He’d been eligible for a healthy pension but enjoyed working.

++ paid off his mortgage

++ given notice to the 30-something woman with toddler that has been living here rent-free for 18 months

++ locked the credit card that was being misused by others

++ reclaimed two bedrooms that had been taken over as storage facilities for others

++ most importantly: improved Dad’s diet and lifestyle

Soon I’ll be making a trip home to get our household up-to-date and to retrieve personal items before returning. I’m not sure how long I’ll need to stay – I’m being flexible. And DH is being really understanding. I’m glad we chose online school for the boys this year. I'm also glad that I have a job that allows me to work anywhere with an internet connection. I saw a photo of a shirt that had ‘2020’ and 1 of 5 stars beneath it with “would not recommend”

Posted in

Investing,

Health

|

5 Comments »

August 9th, 2020 at 10:20 am

I mentioned in a previous post that I have a deadline set for the start of my retirement. And that I have a list of prerequisites to determine whether I’m in a safe-enough-for-me position to retire sooner. Each quarter I evaluate my progress against those prerequisites, and my quarterly check-in for this is aligned with my birthday instead of the standard calendar quarter. That’s because a couple of my prerequisites are based on my 60th birthday so the calculation is simpler.

Result for this check-in: It's not time to retire now, but I’m continuing to make progress!

In order to pull the plug immediately, I’d have to have these things accomplished:

(1) Retirement account on target for 7 figures on 60th birthday

(2) College savings on target for full funding

(3) Mortgage paid off

(4) Savings of basic expenses until 60th birthday set aside

(5) No consumer debt

Currently my progress is:

(1) 100+%

(2) 50%

(3) 39%

(4) 6%

(5) 8%

Assumptions for these calculations: average annual return on investments will be 5%, no further contributions to investments, full funding = 40 semesters (8 x 5 boys), $36,000k annually for basic expenses, starting consumer debt was $10k. (At one time I had negative progress on this! For the record though, it’s at 0% interest.)

The next time I check-in on this progress will be around my birthday.

Posted in

Personal Finance,

Retirement

|

3 Comments »

|

We've gotten to know one of the neighbors

We've gotten to know one of the neighbors