|

|

|

January 27th, 2021 at 04:50 am

I did decide to take family medical leave from work. On the first day of leave, as though it was planned, Dad was unexpectedly discharged early.

It’s time off one area but time on another. I’m looking forward to these months. I hope to focus on three areas: Dad’s return to health (of course!), my twins’ schooling, and my health habits. For Dad there are frequent doses of many drugs to administer, things to check, and appointments to attend. It’s a little stressful because I’m afraid of messing something up. The drug choices and doses have been and will continue to be changed frequently over the coming weeks.

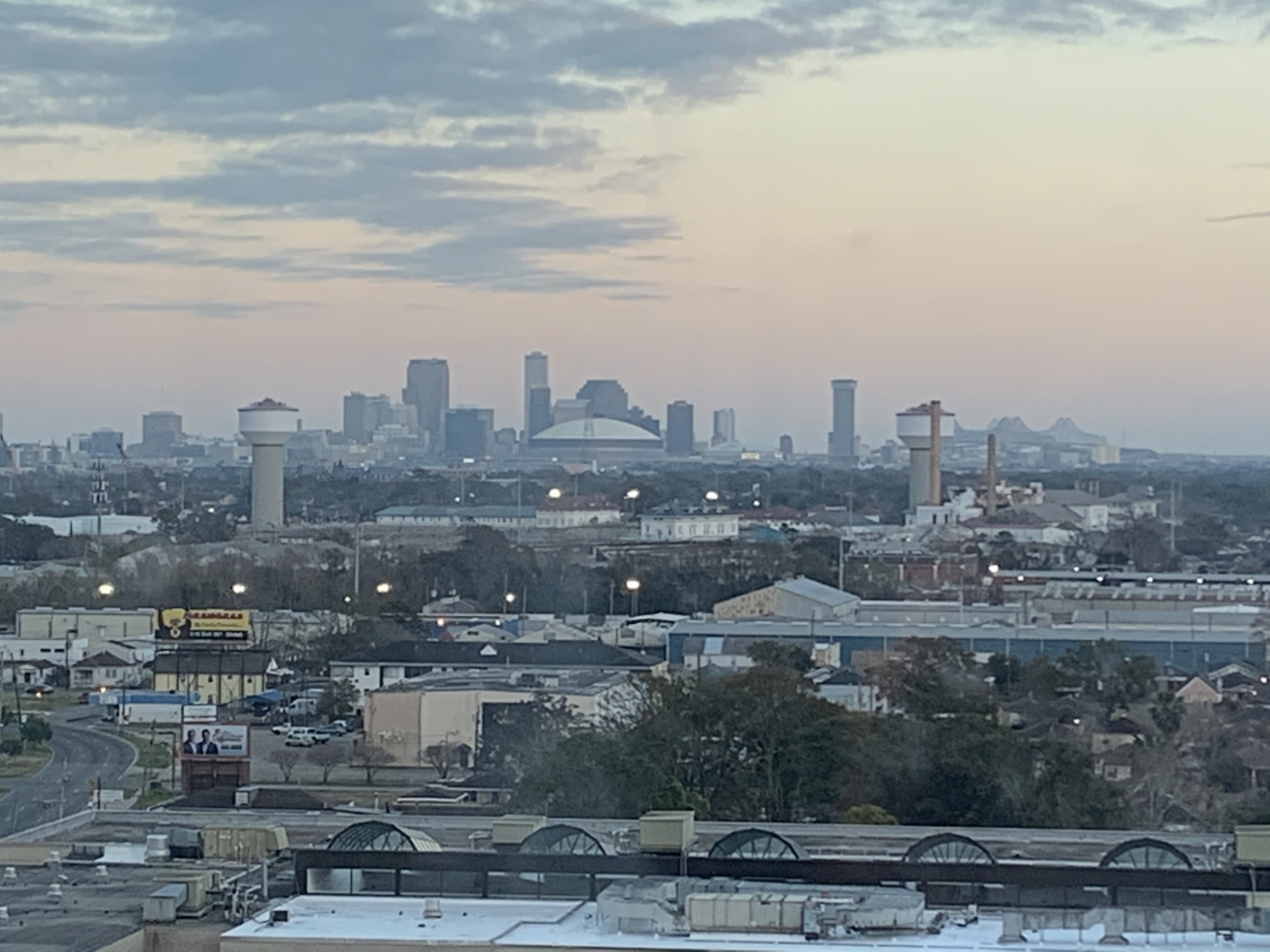

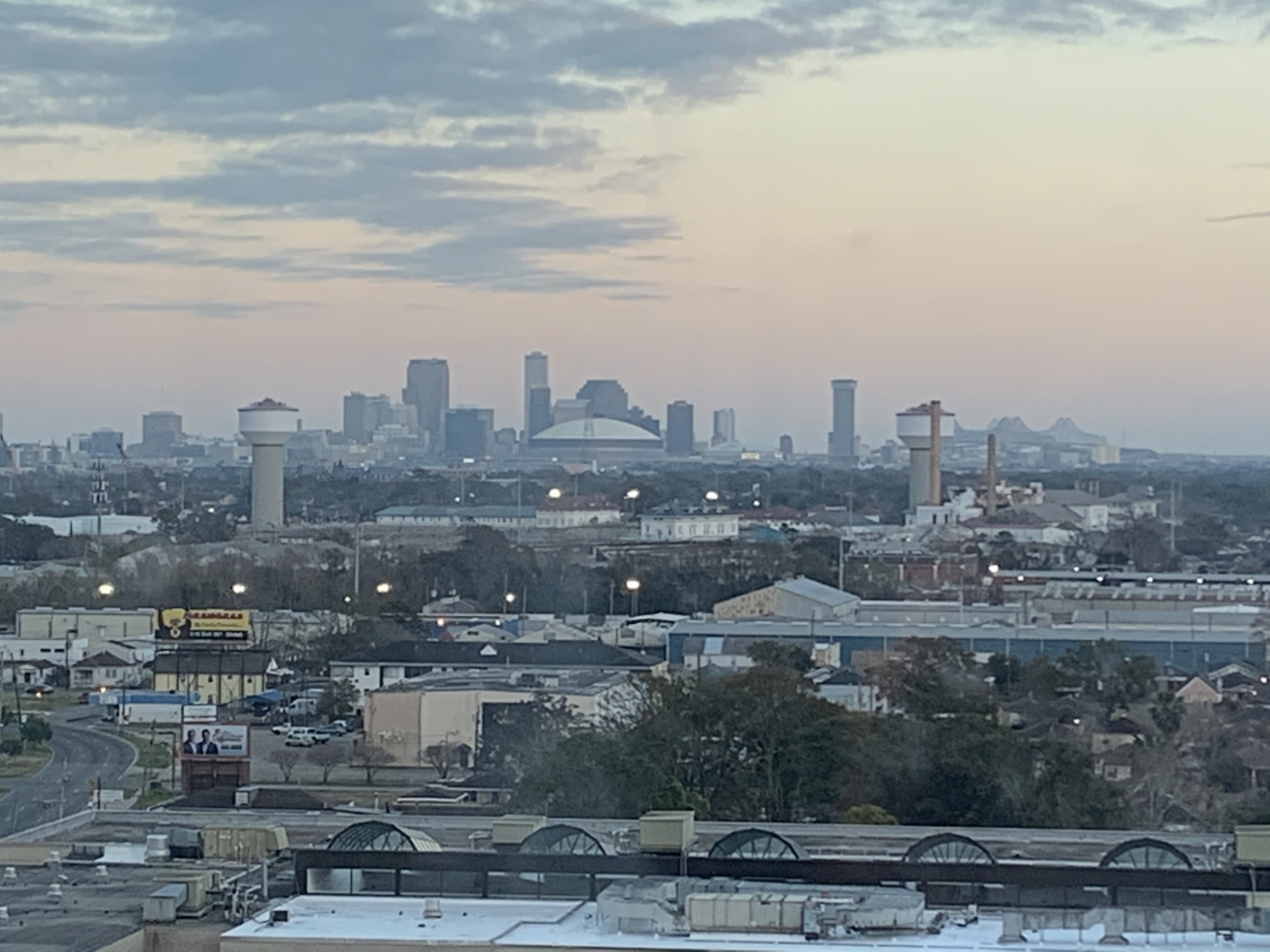

Hospital view

While FML is unpaid time, the company does allow accrued sick time to be used. I am very thankful that I have been well over the years so now I can continue to get paid while I focus this time on the family. I’m hoping too that as Dad gets stronger, we can plan small outings to enjoy the city that is our temporary home. It’s a strange time but these will be memories we’ll hold forever.

My finances have done well on autopilot over the past few months. I’ll get back to regular financial posts after month-end. I hope to have more time to keep up with blog posts.

Posted in

Personal Finance,

Health

|

4 Comments »

January 19th, 2021 at 02:09 am

Well, this time it’s been four months since my last entry – unbelievable and yet so much has happened in that time. I’m still down south helping care for my dad but the tide has turned. After months of effort and care, my dad did qualify for the transplant list and finally, finally yesterday morning in the wee hours, the transplant surgery was performed. It was about 8 hours long and successful. He’s in ICU now and likely has another week in the hospital.

The entire process has been an emotional roller coaster but here we are. He has a chance at life. Now we’re required to live in the same city as the transplant center for a couple of months. My brother and I have rented an Airbnb and are prepared to be caretakers for Dad. I’m evaluating taking a FMLA leave from work.

Over the past few months I’ve taken over the administrative aspects of Dad’s life. Now I look forward to transitioning his life back to him. So to add to the list of accomplishments in the previous post:

++ moved Dad’s IRA to Vanguard (and it’s since gained tens of thousands of dollars in value)

++ removed the 30-something rent-free boarder, changed the locks, & installed security cameras

++ organized the bedrooms that had been occupied by the rent-free boarder

++ hired and managed 24/7 caregivers when Dad’s condition reached a level that required constant assistance

This situation has been really hard on my family but I don’t regret my commitment to my Dad. It was life or death – we had to give it all we had. My brother and I were talking about our journey during the surgery and he said something that resonated: “This is what love looks like.”

Posted in

Health

|

8 Comments »

September 12th, 2020 at 10:15 am

It’s been over a month since my last entry and what a month it’s been. I’m currently down south helping care for my dad as he deals with serious health issues. I arrived in time to prepare and then narrowly miss two hurricanes. One of my brothers lives here but Dad’s condition worsened to a point that my brother didn’t know what to do.

The good news is that Dad is somewhat stable now. I monitor his meds and diet and I’m proud to say that I’ve gotten him to enjoy green smoothies. His mental clarity is back but he’s tired and weak all the time. The best-case scenario is that he’ll qualify for a transplant list so his overall condition is still quite serious.

Everything needed attention: his house, his finances, his health, and a couple of relationships. Dad is generous and gullible and he’s been taken advantage of repeatedly. Some things were obvious to us but the more I organize, the more I find out. I am thankful that he’s thinking clearly now so I can ask questions and support by doing things with his approval instead of just taking over.

One of the next tasks on my Dad to-do list is to move his IRA to Vanguard. He has an advisor account with someone he met who is charging thousands of dollars each year in fees. His money is invested in about two dozen funds. It looks needlessly complicated for a modest retirement account. Dad has agreed and he trusts my judgment. Any suggestions for good funds for retirees? (once I get the funds transferred to Vanguard) My own retirement account is more aggressive since I’m not retired and I’m willing to take on some risk. That’s not Dad’s situation.

I’ve made good progress in my time here so far:

++ gotten Dad to retire. He’d been eligible for a healthy pension but enjoyed working.

++ paid off his mortgage

++ given notice to the 30-something woman with toddler that has been living here rent-free for 18 months

++ locked the credit card that was being misused by others

++ reclaimed two bedrooms that had been taken over as storage facilities for others

++ most importantly: improved Dad’s diet and lifestyle

Soon I’ll be making a trip home to get our household up-to-date and to retrieve personal items before returning. I’m not sure how long I’ll need to stay – I’m being flexible. And DH is being really understanding. I’m glad we chose online school for the boys this year. I'm also glad that I have a job that allows me to work anywhere with an internet connection. I saw a photo of a shirt that had ‘2020’ and 1 of 5 stars beneath it with “would not recommend”

Posted in

Investing,

Health

|

5 Comments »

August 9th, 2020 at 10:20 am

I mentioned in a previous post that I have a deadline set for the start of my retirement. And that I have a list of prerequisites to determine whether I’m in a safe-enough-for-me position to retire sooner. Each quarter I evaluate my progress against those prerequisites, and my quarterly check-in for this is aligned with my birthday instead of the standard calendar quarter. That’s because a couple of my prerequisites are based on my 60th birthday so the calculation is simpler.

Result for this check-in: It's not time to retire now, but I’m continuing to make progress!

In order to pull the plug immediately, I’d have to have these things accomplished:

(1) Retirement account on target for 7 figures on 60th birthday

(2) College savings on target for full funding

(3) Mortgage paid off

(4) Savings of basic expenses until 60th birthday set aside

(5) No consumer debt

Currently my progress is:

(1) 100+%

(2) 50%

(3) 39%

(4) 6%

(5) 8%

Assumptions for these calculations: average annual return on investments will be 5%, no further contributions to investments, full funding = 40 semesters (8 x 5 boys), $36,000k annually for basic expenses, starting consumer debt was $10k. (At one time I had negative progress on this! For the record though, it’s at 0% interest.)

The next time I check-in on this progress will be around my birthday.

Posted in

Personal Finance,

Retirement

|

3 Comments »

August 7th, 2020 at 01:15 pm

So here we are just a couple of months after DS2 graduated and flew the coop. Now DS3 starts college this month. A fresh new round of cobbling together funds to pay the semester’s expenses. This is what Fall 2020 looks like financially:

Total bill from the university for housing, food, tuition, & fees - $10,637. It’s slightly less than I expected, maybe because now the semester ends just before Thanksgiving.

This is how it’ll be funded:

$1,000 scholarship

$2,597 balance of 529 account from old state

$4,000 cash set aside

$ 25 scholarship

$3,015 withdrawal from current 529

I wanted to transfer the funds from our old state’s 529 plan to the current plan after we moved just for simplicity’s sake but the old state informed me that I’d lose the ‘earning enhancements’ that had been paid into my account by the state if I transferred it. It’s just 2%, but still, it’s free money. I didn’t want to leave money on the table so I kept the accounts open. We had accounts there for DS1, DS2, and DS3. I’ve always pulled that money out first so I could close the account. This is the last kid with an account there so finally I’ll be able to close it completely.

Our current state doesn’t provide any contributions but it does provide a state tax exemption for money contributed to a 529 account – ANY 529 account – up to the gift tax exclusion which is around $15k per kid. Since I could choose any 529, I did research back then to find a good one. I selected the Utah plan and I’ve not been disappointed. The fund choices are good (Vanguard), the website is easy to use, and it’s easy to make withdrawals. For that withdrawal, I completed the request online on their website and the money was in my account in two days. In contrast, the old state’s plan doesn’t offer online withdrawals. I had to print out forms, including a tax form, then scan and e-mail them in. Now I’m still waiting for a paper check to arrive. I hope it gets here before the tuition is due. Otherwise I’ll have to temporarily transfer money from a savings account. Grrr.

I set aside $4000 cash per year (at least) from my income so that I’ll qualify for the American Opportunity Credit deduction on our taxes. It provides a refund/credit of $2500 if $4000 was spent on college tuition. It doesn’t provide the credit for money spent on college-related things like housing & food but I’m using 529 funds for that. You also can’t get the credit if you used all 529 funds because that would be double-dipping. You also have to have an AGI of $160k or less. As I type this, it sounds complicated but it really isn’t. Like most things financial, you just have to know the rules.

That $25 scholarship? I’ve waited 10 years to use that! DS3 participated in an after-school bowling camp during the winter of third grade. He’s high energy so I just wanted something active for him to do indoors while I worked in the afternoons. It was a neat setup: the bowling alley sent a bus to school to pick up the kids. They gave them homework time, pizza for snack, and then taught them to bowl. At the end of the week (or two? I can’t remember.), there was a bowling tournament for the kids and DS3 won the $25 scholarship as a prize. We laughed about it and told the grandparents that he already had an athletic scholarship for college at age 8. A couple of times over the years I got paperwork about the scholarship and had to create an account online, updating passwords sometimes. The online request to get the money was straight-forward but they won’t send it to me – it must go straight to the school. It makes me chuckle to think of the person in the bursar’s office who will receive that official scholarship check for $25! So really, I probably worked hard for that 25 bucks but again – it’s free money. I reminded DS3 that his bowling performance is helping him now! I don’t know if he’s bowled since then.

We’ll still have books and the costs related to setting up his dorm room. So I expect to spend another $500 or so. Then I’ll start thinking about next semester.

Posted in

Education,

Kids

|

5 Comments »

August 6th, 2020 at 11:09 am

Despite the continuing market volatility, July was a good month for the net worth. It’s up by $39k.

Since I set up my numbers in Excel last month, now I get to see the total picture that reminds me of my overall progress even during months that don’t look so healthy. I like projecting the lines forward on the graph to see when I might expect to hit milestones.

2011-2020

Posted in

Personal Finance

|

2 Comments »

August 5th, 2020 at 12:02 pm

I’ve shared before that I track the principal payments for our house debt each month. Well this month something exciting happened – the debt dropped down to 5 digits. I’ve still got a long way to go, but it’s motivating to see that progress milestone.

5 figures!

It’s also about 2 years into my 5-year plan so hopefully I can stay on course. To do that will require a progressively increasing principal payment.

Posted in

Debt

|

3 Comments »

August 5th, 2020 at 12:41 am

Yes, I know it’s August! I’ve had a couple of busy weeks and didn’t get around to this.

My 2020 goal #2 is to adopt a permanent health-enhancing habit each month. My new health habit for July was to disconnect one day a week. For me it’ll usually be a Saturday since I work and I’m often getting prepared for the week ahead on Sundays (unfortunately).

On my disconnected day, I will avoid screens. Computer screens, TV screens, ipad mini, and phone.

NEW HEALTH HABIT #7:

Have one disconnected day each week.

BENEFIT:

• Spending more focused time in my relationships

• More likely to spend time outdoors

• Less stress caused by reading ratings-seeking controversial news stories

• Increased productivity since there aren’t distractions

• Less guilt from wasting time on thoughts and activities that really aren’t important

• More time for reflection

• Become more present and authentic.

COST:

Upfront – zero

Ongoing – zero

There might be a cost savings because I can’t order online! 😉

2020 health habits so far:

(1) Fast one day per month

(2) Consume fresh organic juice at least 3 times a week

(3) Stop storing food in plastic containers

(4) Spend at least half an hour outside every day

(5) Drink 32 oz filtered water every day

(6) Do strength training exercises twice a week

(7) Disconnect one day each week.

I remember that CJ once did something similar to this one year for a resolution.

Posted in

Health,

Goals

|

2 Comments »

July 17th, 2020 at 08:15 pm

I got a marketing flyer from my credit union for home loans about a month ago. The rate to refinance was lower than my current rate with PNC and there were no fees or closing costs. It seemed like a no-brainer. After seeing Amber’s success in refinancing, I was inspired to follow-up.

I talked with the representative to verify the no costs, including no prepayment penalties, and then gave them to go-ahead to move forward. The paperwork arrived a few days later and I read the fine print. I saw a gotcha. They assumed that the homeowner’s insurance had a low deductible. I deliberately have a high deductible because I figure that’s what EFs are meant to cover. It keeps my premiums lower. I called to see if that requirement was negotiable and unfortunately it wasn’t. I asked them to trash the application. It’s not worth saving money in one place only to spend it in another.

Posted in

Debt,

Personal Finance

|

2 Comments »

July 17th, 2020 at 12:18 am

So I did drop DS2 from our auto policy once he moved to his own place and bought himself a car as I planned in an earlier post. And our insurance price increased as a result! I guess the insurance company figures that with DS2 out of the picture, DS3 drives the vehicles more. And that’s true. One of the vehicles is in my name but is actually DS3’s – he paid for it. DS2 was 22 with a good student discount. DS3 is 18 without a good student discount. Ah, that’s what I get. I can only imagine how much it’ll be once DS4 and DS5 join the policy. They’ll be getting permits in the Fall and licenses sometime next year. Then I’ll have 3 teenaged boys on the policy. Eeek!

Our current 6-month premium is now $1070. That covers three drivers using two cars with liability coverage only. The liability coverage is 250-500-100.

Posted in

Personal Finance,

Kids

|

4 Comments »

July 3rd, 2020 at 03:35 pm

Once a month I calculate our net worth and today was the day. It’s always just after the mortgage payment hits. We’re up $15k since last month. All the numbers moved in the right direction except our house value. According to Zillow, it decreased by $3k since last month.

I used to use a site call networthiq.com to enter our monthly numbers, but the site shut down. I have kicked myself for being dependent on a site because while I do have monthly net worth totals for the past decade, I don’t have the components of each calculation. Those numbers were all lost when the site shut down.

What I especially liked about the site was seeing the graph of my net worth over the years. It was an encouragement when I felt that our budget was tight. I also enjoyed looking at the numbers for others to inspire me. There is another similar site but it’s not quite as easy to navigate and I’d have to start over. Ugh. So, I finally decided this morning to recreate a net worth tracker in Excel. It was easier than I expected though that’s mostly because it’s not fancy. But I got the graph I wanted. It also graphed each component by default and I started to remove that but then decided it could be interesting to see when lines cross. For example, when my Roth IRA account value exceeds our house debt.

Graphs show trends with one look. The graph so far shows how volatile the markets have been because most of our net worth is invested in the stock market.

Net Worth ride from Oct 2019 to June 2020

I think I’m going to take the time to enter all my monthly NW totals without the components for the past decade into the Excel table. That graph will tell a more complete story.

Posted in

Investing,

Personal Finance

|

3 Comments »

July 1st, 2020 at 09:37 pm

Another quarter has passed so it’s time for my annual goals check-in to keep my goals visible and prompt me to correct course where needed.

(1) Get EF back to 3 months’ basic expenses – DONE! Poodle jumps!

(2) Adopt a permanent health-enhancing habit each month – on target

(3) Renew my professional certification by the September due date – DONE!

(4) Pay no CC interest or fees – on target

(5) Spend time with each kid to encourage his current area of growth – on target

(6) Complete identified home maintenance - behind

(5) Areas of focus:

DS1 – career planning – restart due to Covid-19

DS2 – housing of his own - DONE

DS3 – college transition – in progress & challenging

DS4 – Scout rank advancement – in progress & challenging

DS5 – Confidence, schoolwork – good progress made, will continue in Fall

(6) Next maintenance:

Replace half-bath light/fan – no progress this quarter

Pressure-wash house - DONE

Painting: living room – DONE, family room – no progress, & downstairs ceilings – no progress

Overall, I’m pleased but it’s clear where I need to put some focus. Two of the three remaining home maintenance tasks are to be hired out and one I can do myself. For that one, all I need to do is buy a matching can of paint and get off my duff.

My health habits are going fine, but I still find fasting and water consumption unnatural. In order to stay on course, I really have to think about it and make myself do them.

My professional certification is good for three years so it won’t expire until Sept 2023. I don’t think I’ll be renewing it again.

Posted in

Goals

|

2 Comments »

June 30th, 2020 at 01:45 pm

A few years ago, I read a financial article, book, or blog (I can’t remember unfortunately.) that had an impact on how I prepare for retirement.

Before then I had just focused on a number to achieve for my retirement account – one that would support a ‘retirement phase’ budget with a 4% annual withdrawal. My thought, like many others, was that my retirement date would be the day I achieved that number. I could project that date but not count on it. The article made me rethink the approach and instead think more about my remaining time and its value. So, make the DATE the goal, not the AMOUNT. After reading, I decided to set a deadline for my retirement start date and then work to make that happen. There’s a mental shift, at least for me, in having a “deadline” instead of a “target date”. A target is something that I work toward and hope it works out, but know it might not and that’s okay. A deadline on the other hand is something I work toward with some sense of urgency because if it doesn’t work out, I have to resort to a back-up plan that isn’t as nice. When I have a deadline, I tend to make sacrifices earlier if necessary so I won’t miss it.

June 30, 2025 is my retirement start deadline. I will be retired on that day. It makes me excited just to type that! That makes today a milestone – my retirement is a maximum of 5 years from today. What if I don’t have the magic number in the retirement account? Then I will adjust my retirement lifestyle, but I will not change the date. One thing that has reinforced my view has been this site, where I see several of you in retirement living quite well without a huge nest egg. There are so many accounts too of people who had a sudden disability that resulted in that date being selected for them and they weren’t prepared. And others who achieved their magic number but have the ‘one more year’ syndrome for several years because they worry about the potential flaws in their calculations. I also encountered one of those Monte Carlo simulators that included the probability of being dead along with the probabilities of being broke or wealthy. That drove home the concept to me: I want to control how I spend the rest of my life.

2025 is the year I turn sixty. I can access my retirement account without penalty then. I won’t qualify for Medicare yet. My youngest boys won’t be finished with college. All those factors are included in my planning.

I set a list of prerequisites that must be met if I voluntarily opt to retire before June 30, 2025. In order to allow myself to retire earlier, I have to have these things accomplished:

(1) Retirement account on target for 7 figures on 60th birthday

(2) College savings on target for full funding

(3) Mortgage paid off

(4) Savings of basic expenses until 60th birthday set aside

(5) No consumer debt

I track my progress against those prerequisites each quarter. I have a timeanddate.com countdown set too – today I have 260 more Mondays until my deadline.

Posted in

Debt,

Retirement,

Goals

|

6 Comments »

June 28th, 2020 at 01:47 pm

My 2020 goal #2 is to adopt a permanent health-enhancing habit each month. My new health habit for June is to have two resistance training workouts each week.

I have a book that illustrates a few no-equipment-needed strength-building moves for different body parts. I have a health club membership too where I can use machines. This is an area of weakness for me. (I feel like I’ve said that about several of my health habits!) DH is disciplined with workouts but not with diet. I tend to be the opposite. If we could combine ourselves, we’d be the ideal, or the worst…!

The reason I chose strength training is that as I get older it seems like my muscle tone is deteriorating before my eyes. And I want to maintain my strength so I can remain active as I move into my retirement phase of life. So, it’s for both aesthetic and quality of life reasons.

NEW HEALTH HABIT #6:

Do strength training exercises twice a week.

BENEFIT:

Strength training can do all this & more:

• maintain lean muscle mass

• preserve bone density, reducing the risk of osteoporosis for women

• raise metabolism (once muscle mass is improved)

• reduce risk of injury

• improve balance

• improve the muscle’s ability to use glucose, decreasing blood sugar levels

• reduce cancer risk by lowering visceral fat

• increase mental resiliency (anti-anxiety effect)

• improve flexibility & mobility

COST:

Upfront – zero

Ongoing – $20/month health club membership

2020 health habits so far:

(1) Fast one day per month

(2) Consume fresh organic juice at least 3 times a week

(3) Stop storing food in plastic containers

(4) Spend at least half an hour outside every day

(5) Drink 32 oz filtered water every day

(6) Do strength training exercises twice a week

Posted in

Health,

Goals

|

5 Comments »

June 27th, 2020 at 01:09 am

Today was a milestone day for DS2. He’s moving into his own place. He graduated in May and then started working in a town about a 45-minute drive away. He was unable to get an apartment for months mostly because of Covid-related shutdowns. Property management companies weren’t even showing places. He also had decided only to consider apartments that were biking distance to his work and reasonably priced.

Finally, he found a place that suits him. It’s a two-building complex where each building is a 4-plex and it’s in the town where he works. It’s not pretty-looking on Google maps, but it’s practical for him. There’s even a laundromat across the street. He said he could walk to work in about 15 minutes. It’s basic – a one-bedroom apartment with a bath and a combined living room and kitchen area. He’s living alone though and wanted to live cheaply so he can save money for the next couple of years. I think he’ll be paying about $600/month in rent. In preparation for the move he bought a router for his internet, arranged for utility accounts in his name, bought a window A/C unit, and rented a U-Haul to move all his belongings. I’m surprised that he was allowed to rent the U-Haul since he isn’t 25 yet but he didn’t ask for help so I guess it was okay. Maybe the rental companies are being more lenient since their business is slow these days. But all those things are adult activities and I could tell that DS2 is feeling proud that he’s independent. I’m proud too.

Before he drove away in the big van loaded with his things, he told me that we could go see his place in a week. I think he wants time to get his place sorted before he shows it off to us.

DS4 helping DS2 load the moving van

I guess my next move is to have DS2 removed from our auto insurance. Hopefully that will save a few bucks because having DS3 on the policy is costing us plenty.

Posted in

Goals,

Kids

|

6 Comments »

June 23rd, 2020 at 01:31 am

I have met my first goal for 2020: Get EF back to 3 months’ basic expenses. It feels nice especially in the current economic environment. For us three months of expenses is $10,500 and the EF bumped to $10,700 with my recent regular monthly contribution. It was close last month but I didn’t feel comfortable taking funds from something else and throwing it in.

I’ll be evaluating my progress on all annual goals at the end of the quarter which is in just a couple of weeks.

I may set a goal in 2021 to get the EF to 6 months of expenses.

Posted in

Saving Money,

Goals

|

3 Comments »

June 22nd, 2020 at 02:05 am

June 21st – the longest day (for natural light) of the year. I love the long days and made a point to spend a good part of the day outside. The only bad thing is that the days get shorter from here, already. DS4 started his life-guarding job today. He has rosy cheeks from the sun so he’ll remember to take sunscreen tomorrow. My boys don’t usually burn because their skin has a slight olive tone like mine – even the blond one – but it is the very beginning of the season here so they need to be careful now.

On the money front: I received an EOB from Aetna and they paid DH’s antibody test at 100%, like a preventive service would be covered. I didn’t expect that. It was $55.

Posted in

Personal Finance,

Kids

|

1 Comments »

June 19th, 2020 at 03:40 pm

I redeemed credit card points for a $50 Subway gift card. I like choosing a physical card so I have the option of using it or gifting it. In this case, it’s likely I’ll use it to treat the family to our local Subway since we are no longer ordering out. They are open for pick-up only. The previous gift cards I ordered with points were for Staples and Lowe’s.

Posted in

Personal Finance

|

1 Comments »

June 17th, 2020 at 01:45 pm

The stray cat that we adopted is now neutered. Twice the surgery was scheduled and cancelled, I think because the county wasn’t officially yellow yet so non-life-threatening surgeries weren’t allowed. (even for animals) This time it didn’t get cancelled thank goodness. We’ve been eager to get this done because this male cat had been marking his territory in our house. I think the behavior has stopped now.

The total bill for neutering (including IV fluids and pain meds) and microchipping was $407.

Posted in

Personal Finance

|

0 Comments »

June 16th, 2020 at 12:18 pm

We received another refund from the high school. This time it was $20 that we had paid for a class lab fee. It was refunded since the school was closed in March. That class – Foods – wasn’t fun for DS4 to do online. It would have been a challenge to make fun & interactive online and that teacher just wasn’t the type to change her lesson plans. The school just sent out a survey to get feedback on parent preferences for safety measures vs going online so I guess the Fall semester is in the air. Hopefully if it is online the teachers have time to learn how to teach effectively that way.

Posted in

Kids

|

1 Comments »

June 13th, 2020 at 02:20 am

About a month and a half ago the company announced a contribution matching initiative for donations to Covid-19 support organizations. The employee contribution can be to any qualifying organization that is helping prevent the spread of Covid-19 or addressing other damage caused by it. The match from the company though will go to one of about half a dozen organizations that the company has chosen. The employee can select which one. And it’s clear from the wording of the memo that the company thinks that those organizations would be ideal for the employee’s contribution too.

So here’s the rub for me: First, we just all took 10% mandatory pay cuts. But more importantly, while the organizations chosen by the company are reputable, they don’t reflect my personal values around the pandemic. In my opinion, all the guidance provided by the government and health organizations has been a defensive strategy – avoiding the virus. That’s fine. But what seems to be missing is a complementary offensive strategy – planning for the encounter that is likely to happen and making all of us healthier so we aren’t taken down by the thing. I wish we’d spend some of the money being thrown around to provide Vitamin D (& C and zinc) for free to anyone who wants it. This is my view – I know everyone doesn’t think like I do.

I opted not to contribute and instead our family found ways to support our local community. Now I wonder though: will it hurt me at the company? Do they keep a record of who participated in the initiative they promoted?

Have you ever skipped a work fundraiser and worried that it could negatively impact you at work?

Posted in

Personal Finance

|

4 Comments »

June 11th, 2020 at 12:50 am

When FIL died at the end of January, he left most of his assets (IRA & other accounts, vehicles, etc.) to his wife. In his will he left one savings account to be split among his grandsons. Noone expected this. Our boys will each receive about $10k in the next month or so. They each inherited a gun from FIL too but they weren’t surprised because they’d been asked in past years which one they preferred. (FIL was an outdoorsman.) His will might be entertaining for another hunter to read because one line after another says something like “To my GS1 I leave my Winchester blah blah rifle with the blah blah scope, serial number blah blah” through about 20 guns. He covered all his grandsons, his sons, his son-in-law, former son-in-law, step-son-in-law, former boyfriend to his daughter, and his daughter.

I’m not eager to have those guns in the house – I resisted this with DH for the past decade because our boys were the have-to-touch-everything type of little boys. I guess I’m glad at least that they are older now and two of them don’t live at home any longer.

As for the money, because two of our boys are minors, we will be given the money on their behalf. The other three will receive it directly. I told the twins (DS4 & DS5) that I would allow them to spend some of their money if they chose to but that I would be doing it on their behalf. I’m not trying to be controlling but I just don’t want them to be vulnerable to someone taking advantage of them. In fact I worry about DS3 in that regard but he is 18 and typically not receptive to advice from me.

This is what each boy plans to do with his windfall:

DS1 - $5k to Roth IRA now for 2019 since the deadline is extended, $2k student loan debt, $3k current desires including $1k to “play” with stocks

DS2 – All of it to top off Roth IRA for 2019 and 2020

DS3 – undecided, but has talked about a newer more reliable car

DS4 - $1k to buy the bed he wants, $9k to savings for a car purchase after he’s 18

DS5 – up to $3k for a fancy gaming computer setup, $7k to long-term savings with no goal yet

I’m curious to see if all their plans stick when the money arrives.

Posted in

Personal Finance,

Kids

|

3 Comments »

June 9th, 2020 at 12:32 pm

Posted in

Uncategorized

|

1 Comments »

June 9th, 2020 at 02:02 am

In our county hair salons aren’t yet open. I haven’t been covering my grey hair growth except with a temporary solution when I’m forced to do a video conference. I have to say I’m starting to like the grey and I’m seriously thinking of keeping it. My hair is now naturally salt & pepper with the salt/pepper proportions different in some places.

Once salons open I may even ask my hairdresser to dye it all grey and then I’ll just have some dark roots but less over time. A while back I saw a model online with grey hair even longer than mine and I liked the look. (Rosemarie Fern is the name in case you want to search.) I think that influenced me to break that unwritten rule that middle-aged women shouldn’t have long grey hair.

Anyone else considering a permanent switch to grey?

Posted in

Saving Money

|

13 Comments »

June 7th, 2020 at 08:24 pm

A few weeks ago I was celebrating the arrival of unexpected money: $212 from the car insurance for cancelling Bertha (minivan that departed), $54 voluntary refund from insurance to account for the stay-at-home order, and $40 refund from the school for the pay-to-play fee since the sports season was cancelled.

I also cancelled the 0% CC that was paid off which didn’t bring in money but did simplify my financial life by removing an account.

Then it went the other way and in a big way. The company implemented a 10% pay cut on total compensation across the board. The reasons were valid – they are trying to avoid layoffs and foresee the revenue being much lower this year. The pay cut is supposed to be for this fiscal year only and if the revenue doesn’t fall as sharply as anticipated, we may get some of it back later. Other cuts were made too – travel, hiring, and summer interns were some of them.

As a result, I had to make tough decisions about items in our family’s budget to cut or eliminate. No more ordering in dinner from local businesses once a week. No more family trip planned for this summer. Of course it wasn’t fun relaying this information to the kids but despite it being unpleasant, I did think it was a teachable moment. They got to see my response (as our family’s CFO) to a sudden unexpected reduction in income. And we’ll be fine.

I wish our local school board had enough fiscal maturity to go through that exercise. They also have realized that revenue will be impacted by the shutdown this year and instead of making tough decisions on budget line items, they are planning to raise taxes in hope of making up the difference! I usually don’t have strong feelings about local politics, but this time, maybe because of my situation, I am annoyed by them. One of every five neighbors is unemployed and probably wondering how they will pay the whopper property tax bill this year without selling their homes and you’re going to raise it? Such a lack of compassion and responsibility.

Posted in

Budgeting,

Personal Finance

|

5 Comments »

June 1st, 2020 at 12:01 am

I’ve been on a slight hiatus due to feeling overwhelmed and discontinuing unnecessary tasks as a result. And it wasn’t directly because of the country’s 3-month turmoil either but instead my fretting about family members I love. In two separate situations (DS3 and my dad), I watched consequences from poor choices while I was powerless to do anything. But pray, which I did. Both situations eventually resolved themselves better than I thought possible but boy – I feel like I lost a year off my life from the stress. I really wish I knew a secret to truly let go of situations out of my control when they’re close to me.

The good news is that I have been keeping up with the high priority items directly in my control. So back to regularly scheduled programming…

My 2020 goal #2 is to adopt a permanent health-enhancing habit each month. My new health habit for May is to drink 32 oz of filtered water each day. (in addition to any other liquids I consume)

I think the ideal water intake for an adult is more than this but it’ll be a step up for me. I have a good quality water bottle that I keep at my desk. Two fill-ups should be at least 32 ounces.

NEW HEALTH HABIT #5:

Drink 32 oz of filtered water every day.

BENEFIT:

Drinking water positively impacts brain function, energy levels, digestion, and metabolic rate. Water intake eliminates headaches caused by dehydration and can prevent kidney stones. It aids in detoxification and lubricates joints, eyes, and skin.

COST:

Upfront – zero (I already have a filter.)

Ongoing – zero

2020 health habits so far:

(1) Fast one day per month

(2) Consume fresh organic juice at least 3 times a week

(3) Stop storing food in plastic containers

(4) Spend at least half an hour outside every day

(5) Drink 32 oz filtered water every day

Posted in

Health,

Goals

|

2 Comments »

April 25th, 2020 at 01:24 am

It was time for my annual purchase of sneaker shoes and I did it online since stores are closed. I typically order clothes online but shoes have been different – I feel like I need to try them on to make sure the size is okay. The shoes arrived and they’re fine. It was actually a time-saver so I’ll consider purchasing online next year.

Each year in the spring I purchase a new pair and my current pair becomes my yard shoes. That pair eventually gets green soles from fresh-cut grass and dirt stains from the flower beds. I use them until Octoberish when the last mowing is done for the year, then I throw them away. The following spring my everyday sneakers become my yard shoes when I buy a new pair.

Do others rotate shoes? Or do you purchase a pair to be yard shoes from the start? Or do you stay cleaner than me in the yard?

Posted in

Personal Finance

|

3 Comments »

April 23rd, 2020 at 12:35 pm

Chipotle spread

I track our spending and overall we’re spending less but we’re spending a lot more in two budget categories: home maintenance and restaurants. It’s to pay for local places that are open like house & yard services and restaurant delivery/pick-up once a week. The once-a-week food delivery is expensive because we have big boys with big appetites but it’s becoming a homebound tradition, and I feel good about supporting the local businesses.

I usually order a variety of options instead of full meals, then we put everything on the island in the kitchen so we can each sample a variety of interesting items. So far our weekly meals have been Japanese for DH’s b-day, Indian twice (now it’s pick-up only), Italian once (not as healthy but fresh & super tasty), and Chipotle this week. I’m avoiding fast food places that would admittedly be cheaper but are also unhealthy.

For next week I’m looking at a local Mexican restaurant that initially closed for the shutdown but has just reopened for delivery or pick-up. I doubt they anticipated the shutdown lasting so long when they closed.

For the house, we had pressure washing done and we just had mulch delivered in anticipation of yard work this weekend.

Posted in

Budgeting,

Personal Finance

|

4 Comments »

April 22nd, 2020 at 04:27 pm

Today was exciting because it’s the first CSA delivery of the year. Our first box contained spring onions, Tuscan kale, green chard, wintered kale, radishes, and gold potatoes and one butterkin squash from winter storage.

I’ve already made green smoothies for us with an assortment of the greens. I feel healthy just knowing that we’ve got just-harvested organic greens in our bodies.

Smoothie raw materials – 2 types of kale + radish greens

Posted in

Health

|

3 Comments »

April 21st, 2020 at 06:59 pm

My 2020 goal #2 is to adopt a permanent health-enhancing habit each month. I’ve decided that my new health habit for April will be to spend at least half an hour outside every day.

It’s a shame that I have to work to make this a habit but I do. Even working from home, some days I realize that I didn’t get out at all except to pick up the mail. Especially when the weather is cold. So now unless there’s a bad storm or the temperature is in the single digits, I’m going to spend time outside. It doesn’t have to be for exercise – I could just drink my coffee on the deck. Part of it is covered so I could do that on a rainy day too.

NEW HEALTH HABIT #4:

Spend at least half an hour outside every day.

BENEFIT:

Provides a de-stressing effect, might improve short-term memory, creativity, and the ability to focus, reduces inflammation, helps eliminate fatigue, may prevent depression, may protect vision, lowers blood pressure, may boost the immune system

COST:

Upfront – zero

Ongoing – zero

Cheap and simple.

2020 health habits so far:

(1) Fast one day per month

(2) Consume fresh organic juice at least 3 times a week

(3) Stop storing food in plastic containers

(4) Spend at least half an hour outside every day

Posted in

Health,

Goals

|

2 Comments »

|